The Odds Favor Growth

Capital markets don’t hide their expectations for the future; they hold them out for all the world to see.

Assuming you know where to look.

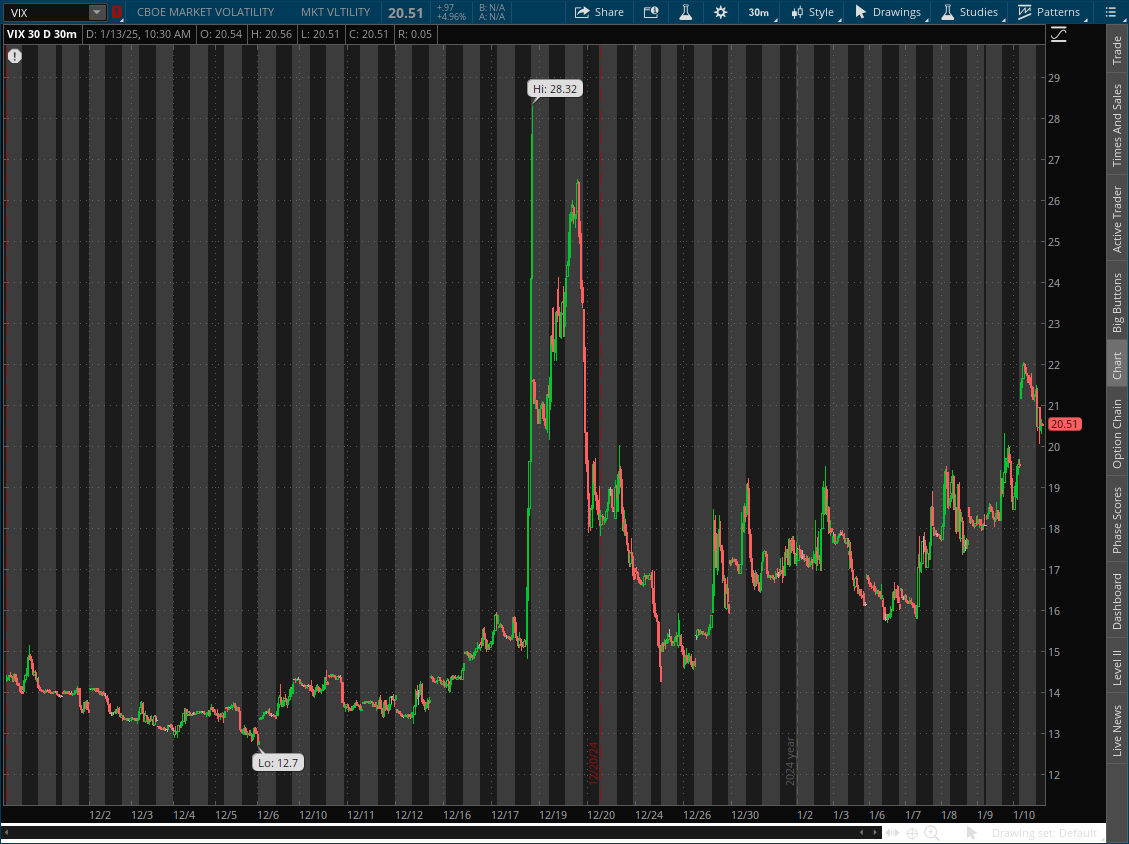

Like that notorious gauge of uncertainty, the VIX Index. It provides direct evidence of the range markets expect the S&P 500 Index to trade within based on option prices.

As of today, the VIX at 20% implies roughly 5.7% moves in the S&P 500 over the next 30 days, putting the likely price range between 6,157 and 5,488.

Source: TOS

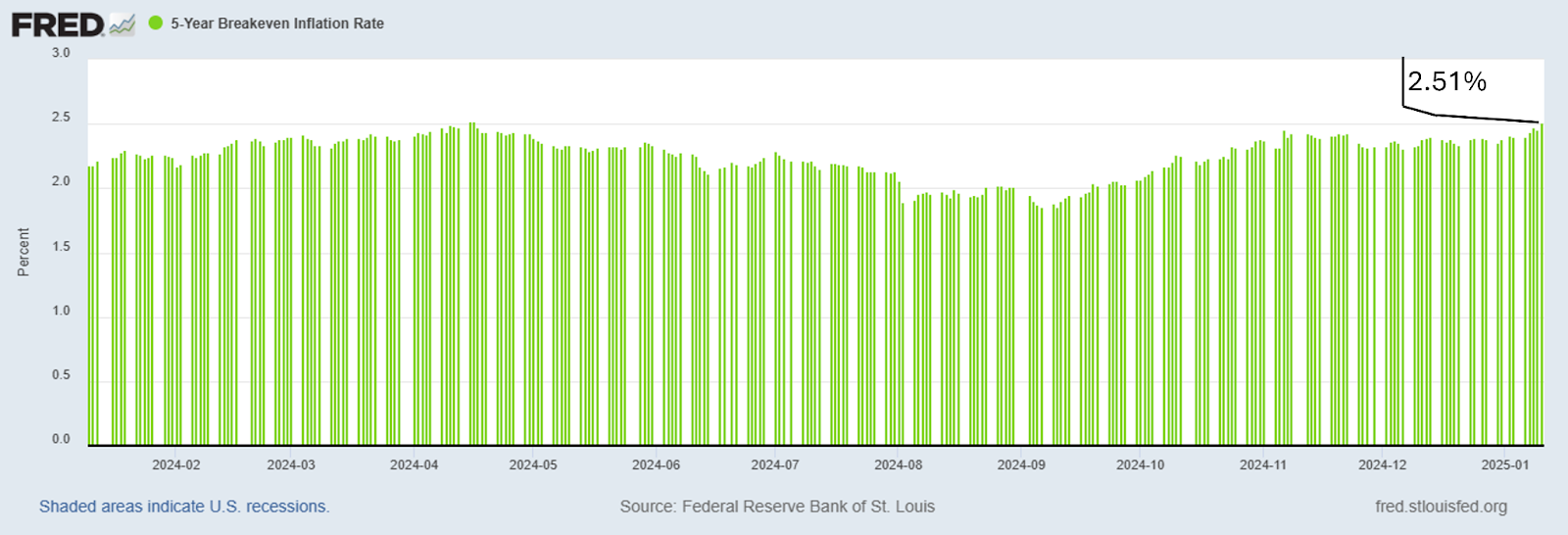

I have also shown you what markets expect of inflation. By comparing 5-year treasury yields to 5-year inflation-index bond yields, you can observe what markets expect from inflation over the same term.

At the time, inflation expectations were 2.41%, but they have increased by 10 basis points to 2.51% over the past week.

Now, don’t take these expectations as hard and fast predictions. They are implied by current prices (the “I” in VIX stands for implied). And markets adjust prices and expectations as new information is received.

Instead, look at them as even-money bets at that moment. It’s like an over/under, with market pricing 50% odds that volatility or inflation will be higher than 5.7% and 2.51%, respectively, and 50% odds that they will be lower.

A stock price has a built-in over/under, too. When you like the over, that’s when you buy.

As we head into another earnings season, you should know that the over implied by American stock prices is higher than that of any other market.

And despite the high odds, I’m still taking the over.

Here’s why…

The Profitability Over

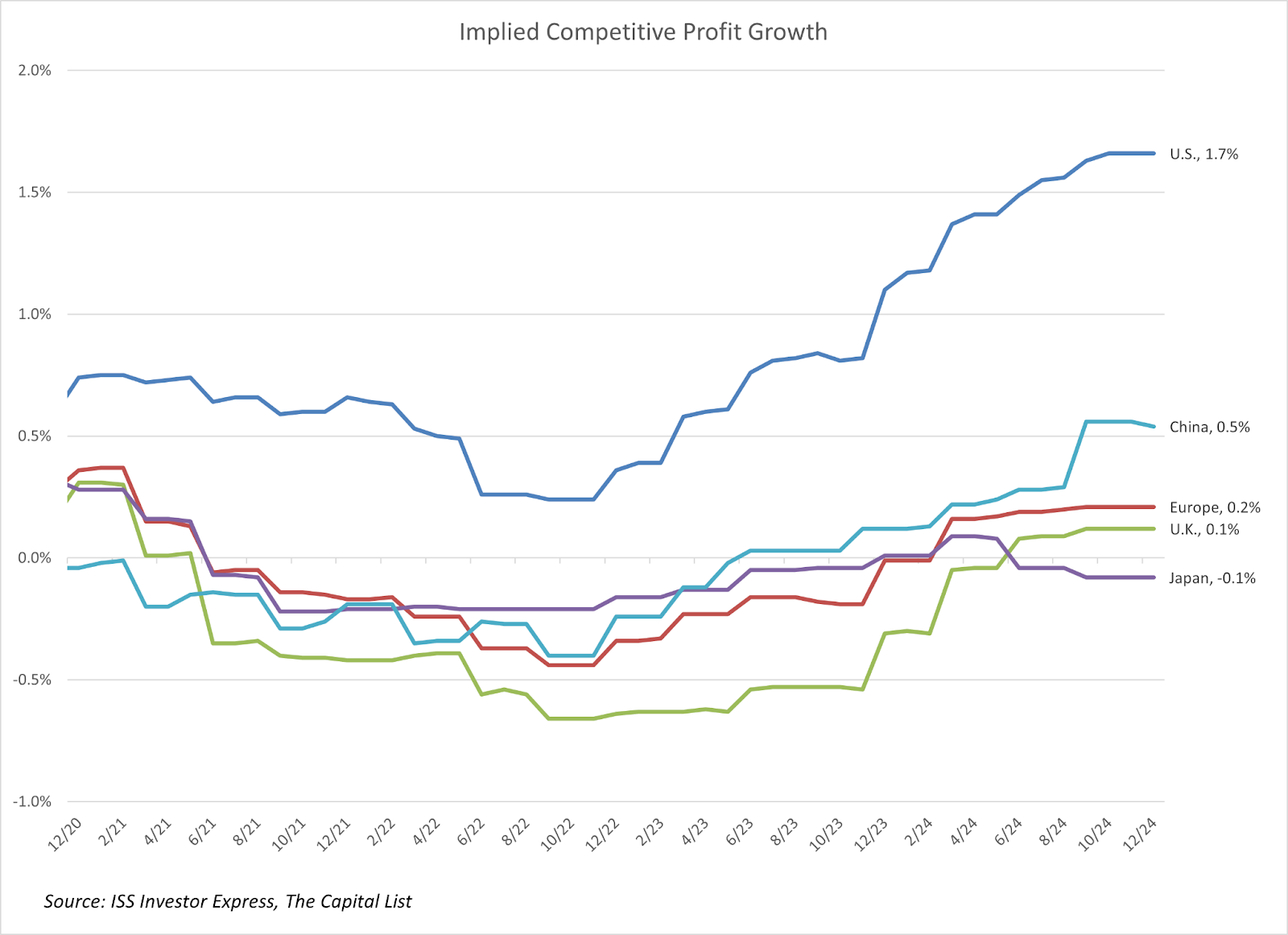

The chart below shows the competitive profit growth implied by stock prices across top global markets.

These are the growth rates that profits must exceed to justify current prices. If aggregate profit growth exceeds these rates, stocks should rise in these markets. If they come up short, they will likely fall.

U.S. stocks sport the highest required growth rate at 1.7%, well above what markets demand of Chinese, European, British, or Japanese stocks.

At first glance, this might indicate an overvalued U.S. market.

But that’s the wrong take. It simply means that markets expect less profit growth from these other markets. Their price reflects lower expectations.

What decides the bet is your assessment of the factors that could push profits to hit the over.

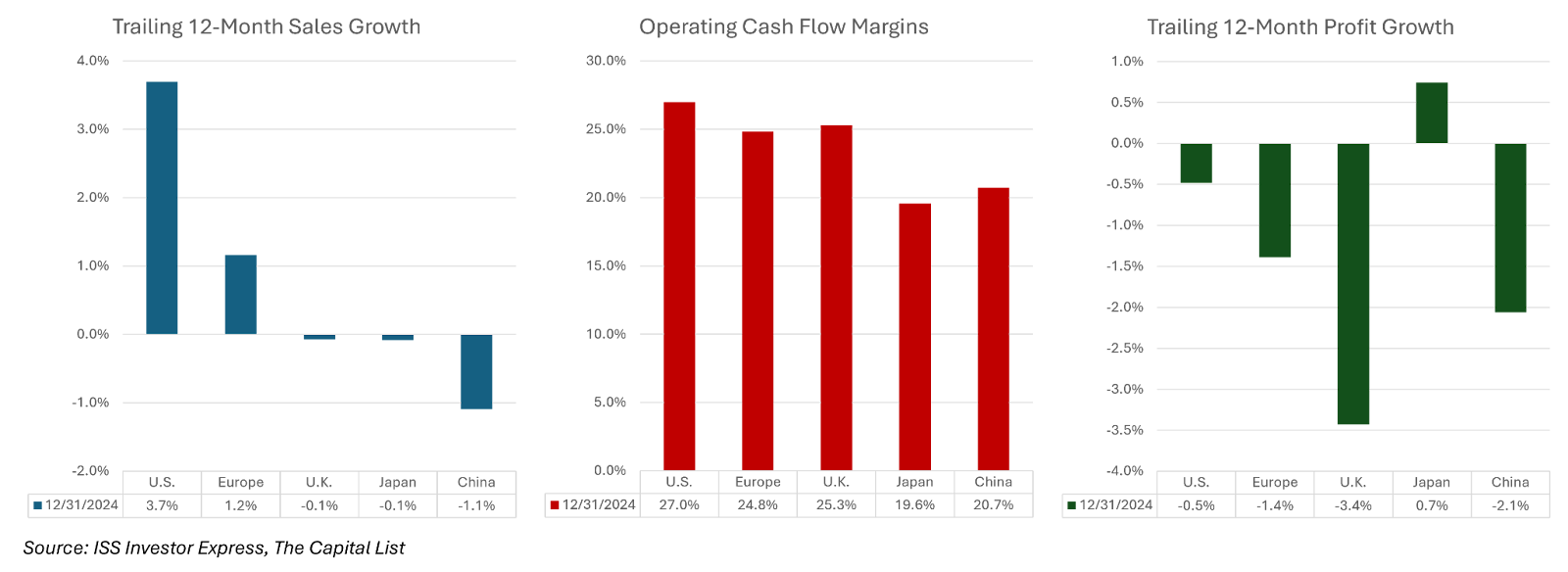

So, to help make that assessment, let’s examine a few factors that drive profits, starting with sales, operating cash flows, and historical profits.

At 3.7%, American companies have experienced the highest sales growth by a wide margin.

Operating cash flow margins are also the highest in the U.S.

Only Japan has realized higher profitability growth rates over the prior 12 months. Since profits for Japanese companies are growing at a higher rate than the -0.1% growth implied by stock prices, this could also work in favor of Japanese stocks.

If you want to take the over on Japanese stocks, buy iShares MSCI Japan ETF (NYSE: EWJ).

For American companies, I expect all of these factors to surprise to the upside, or over-perform, over the coming years for the following reasons.

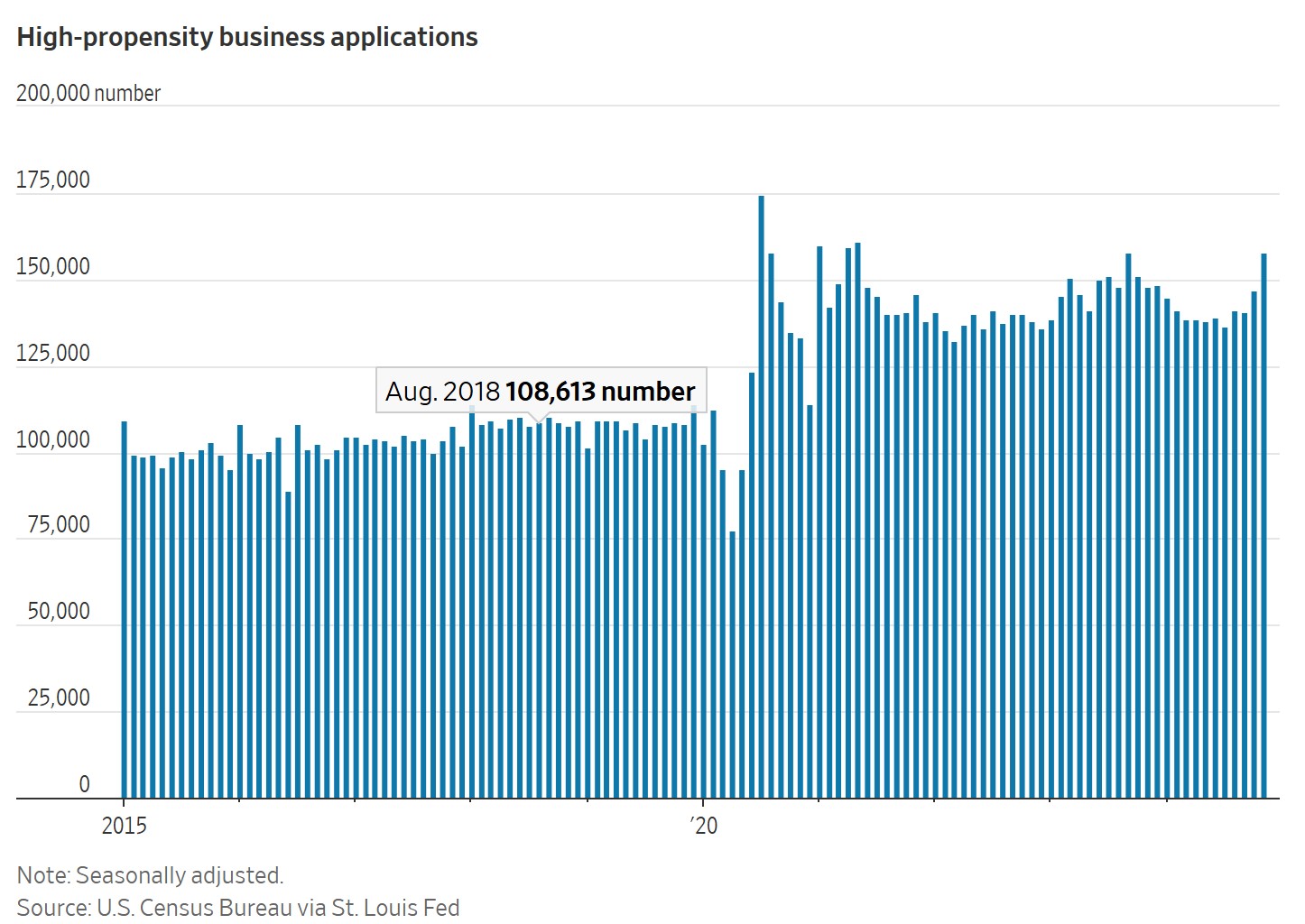

First, AI is already leading to significant productivity gains. Second, high and rising entrepreneurial business formation speaks to confidence among the productive class.

Third, the Department of Government Efficiency will start excising the parasite class from federal bureaucracy next week, reducing budget deficits dramatically which also reduces upward pressure on rates.

And, fourth, the deregulatory wave that follows DOGE, booming capex, and growth will pull even more investment into the U.S. no matter what the tariffs.

There’s a powerful cocktail of bullish factors sweeping through American companies that make “Taking the Over” a clear and simple bet.

Think Free. Be Free.

Don Yocham, CFA

Managing Editor of The Capital List

Related ARTICLES:

American Exceptionalism, v2.0

By dustin

Posted: February 12, 2025

The Holy Trinity of Growth

By dustin

Posted: February 7, 2025

The War for the American Way

By dustin

Posted: February 7, 2025

Draining the Moat

By dustin

Posted: February 2, 2025

Deep-Sixed AI Dreams

By dustin

Posted: January 28, 2025

From FUD to Oil and Gas Clarity

By dustin

Posted: January 25, 2025

Waking Up to the “Drill Baby, Drill” Dream

By dustin

Posted: January 22, 2025

This Ain’t Your Mother’s Internet Bubble

By dustin

Posted: January 21, 2025

Tariff Winners and Losers

By dustin

Posted: January 17, 2025

The Odds Favor Growth

By dustin

Posted: January 14, 2025

FREE Newsletters:

"*" indicates required fields