The Big Lie

The obvious and uncontestable mission of all companies is to maximize shareholder wealth.

Shareholder wealth increases as a company’s share price rises. I’m not talking flash-in-the-pan momentary pops, but sustained rising prices that an investor can count on.

Companies that deliver this consistency are working for shareholders.

And to maximize wealth, companies must deliver cash flows that out-compete other investment alternatives.

Delivering on that mission is the job of a company’s corporate executive team.

Our job as shareholders is to know which executive teams create wealth and which destroy it.

And that’s not easy.

Financial statements hide as much information as they reveal.

As you will learn from The List, the accounting standards governing financial reporting tell us nothing about a company’s cash flow-generating capacity.

Earnings per share miss the mark of revealing true profitability by a wide margin. EBITDA is not cash flow. And P/E ratios come with so many ifs, and, or buts that they can mean whatever you want.

Professional investors know that earnings and other traditional financial metrics are unreliable guides to a company’s competitive cash flow and actual profitability.

They have methods for filling in the gaps, but that insight isn’t available to independent investors.

The problem boils down to this basic fact: Traditional accounting rules like GAAP don’t hold executive teams accountable for the capital they invest—capital being the investments executives make to earn income.

As a result, financial statements massively undercount capital.

Over time, this undercounting lets CEOs off the hook. What looks like profits in the future rarely cover the investments made in the past to make them.

In fact, when you adjust to account for capital correctly, well over half of all companies in the United States don’t cover the cost of those investments.

Stated differently, this bottom half doesn’t add value, so they don’t create wealth.

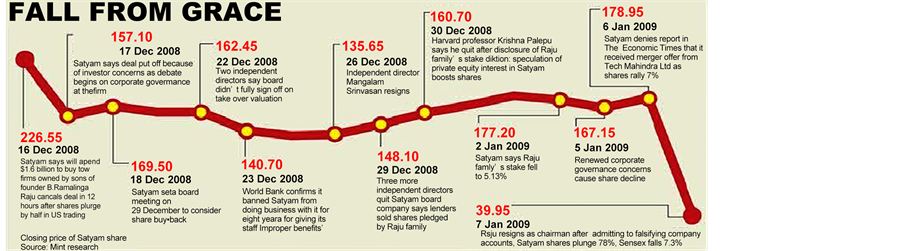

Unfortunately, how companies account for capital is also only half of the problem. The other half is that executives entrusted with your capital routinely lie to shareholders.

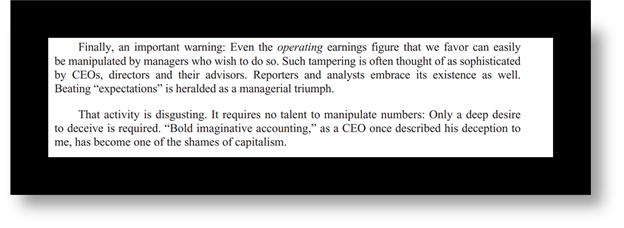

Accounting rules make for an easily manipulatable mess. And investors like Warren Buffett know it.

In his latest shareholder letter, he warned against relying on traditional financial statements by stating:

Source: https://berkshirehathaway.com/letters/2022ltr.pdf

Sadly, most CEOs consider massaging financial statements their mission.

It’s easier to boost the stock price through manipulated financials to hit bonus targets than do the hard work of creating wealth.

“Bold and imaginative accounting,” indeed.

But The Capital List is here to help you see past those lies.

We’re on a mission to identify companies that create shareholder wealth and avoid those that destroy it.

Check out this note to learn exactly what financial statements get wrong and how to fix them.

Together, we’ll hold capital to account.

Think Free. Be Free.

Don Yocham, CFA

Managing Editor of The Capital List

Related ARTICLES:

American Exceptionalism, v2.0

By Don Yocham

Posted: February 12, 2025

The Holy Trinity of Growth

By Don Yocham

Posted: February 7, 2025

The War for the American Way

By Don Yocham

Posted: February 7, 2025

Draining the Moat

By Don Yocham

Posted: February 2, 2025

Deep-Sixed AI Dreams

By Don Yocham

Posted: January 28, 2025

From FUD to Oil and Gas Clarity

By Don Yocham

Posted: January 25, 2025

Waking Up to the “Drill Baby, Drill” Dream

By Don Yocham

Posted: January 22, 2025

This Ain’t Your Mother’s Internet Bubble

By Don Yocham

Posted: January 21, 2025

Tariff Winners and Losers

By Don Yocham

Posted: January 17, 2025

The Odds Favor Growth

By Don Yocham

Posted: January 14, 2025

FREE Newsletters:

"*" indicates required fields