Tesla: The Ultimate Trump Trade

“Trump trades” are all the rage right now.

But that trade isn’t really “this stock” or “that stock.” It’s the whole market.

Tax cuts, lower deficits, and less regulation benefit almost all companies. Plus, the expanding capital expenditure budgets to keep pace with AI-fueled innovation provide the ideal source of growth to keep this economy growing at a higher-than-average rate.

Capital won the election, pulling in a tide to lift all boats.

However, a few sectors stand to gain the most from looser regulations.

First and foremost is the energy sector.

The “drill baby drill” directive will unlock investment that current downright hostile policies have sidelined. Companies like Exxon Mobil (NYSE: XOM) plan to build natural gas-fired power plants on-site tailored to rigorous data center requirements to satisfy the pull of AI energy demand.

And niche plays that tap the emerging hydrogen market also show the “Trump trade” promise.

The deregulatory stance will also benefit financial institutions. Tariffs will boost the industrial and manufacturing sectors. And defense contractors like Lockheed Martin (NYSE: LMT), Northrop Grumman (NYSE: NOC), and General Dynamics (NYSE: GD) will benefit from heightened military expenditures.

Trump’s new pick for SEC Chair, a strong crypto advocate and former head of the SEC, represents a 180-degree turn on crypto from Gensler’s Bitcoin-bashing stance.

And then there’s the curious case of Tesla (NASDAQ: TSLA).

Eliminating EV subsidies is definitely on the table. This will crush the marketability and profitability of most EV manufacturers. But Tesla stands to gain.

This ultimate Trump trade, up 79% since election day, doesn’t need subsidies and will gain from other auto manufacturer’s pain.

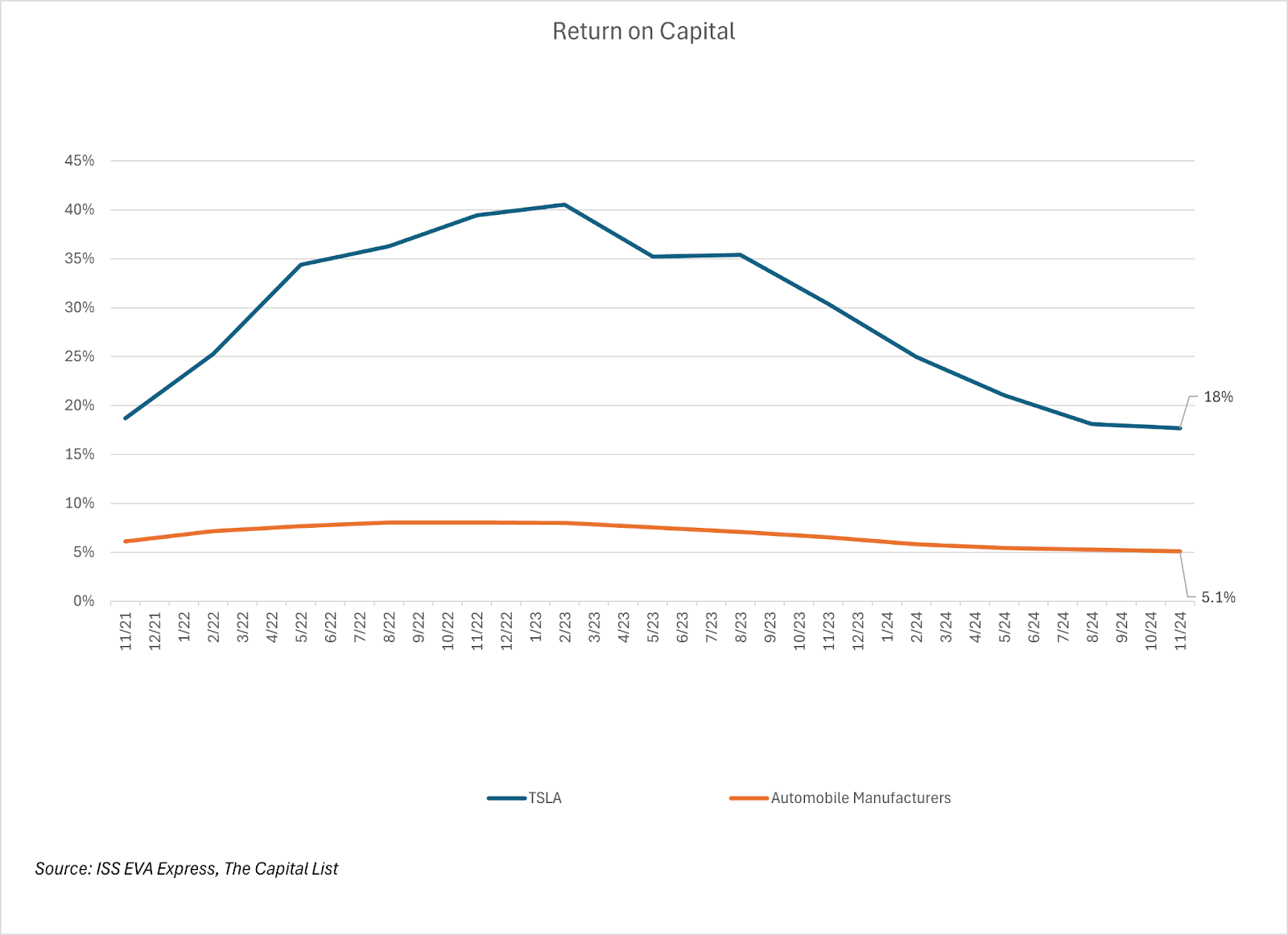

The company generates an eye-popping 18% return on capital compared to an average of 5% for the auto manufacturing industry as a whole.

But at $434 per share, is Tesla worth the price?

It’s not Nvidia (NASDAQ: NVDA) after all. And next week I’ll dive into the valuation for you to see whether this ultimate Trump trade still has legs.

Think Free. Be Free.

Don Yocham, CFA

Managing Editor of The Capital List

Related ARTICLES:

AI Eating Itself

By Don Yocham

Posted: December 20, 2024

Tesla: The Ultimate Trump Trade

By Don Yocham

Posted: December 16, 2024

Markets Rising for a Reason

By Don Yocham

Posted: December 13, 2024

Gensliger’s Out

By Don Yocham

Posted: December 5, 2024

The Elemental Energy Link

By Don Yocham

Posted: November 21, 2024

Holding Capital to Account

By Don Yocham

Posted: November 1, 2024

Energy To Ride Out the Storm

By Don Yocham

Posted: October 30, 2024

Coming Down the Mountain

By Don Yocham

Posted: October 9, 2024

The Next AI Contender

By Don Yocham

Posted: October 2, 2024

The Price of Profits

By Don Yocham

Posted: September 27, 2024

FREE Newsletters:

"*" indicates required fields