Holding Capital to Account

To paraphrase Trump, Big Tech has spent “bigly” on AI data.

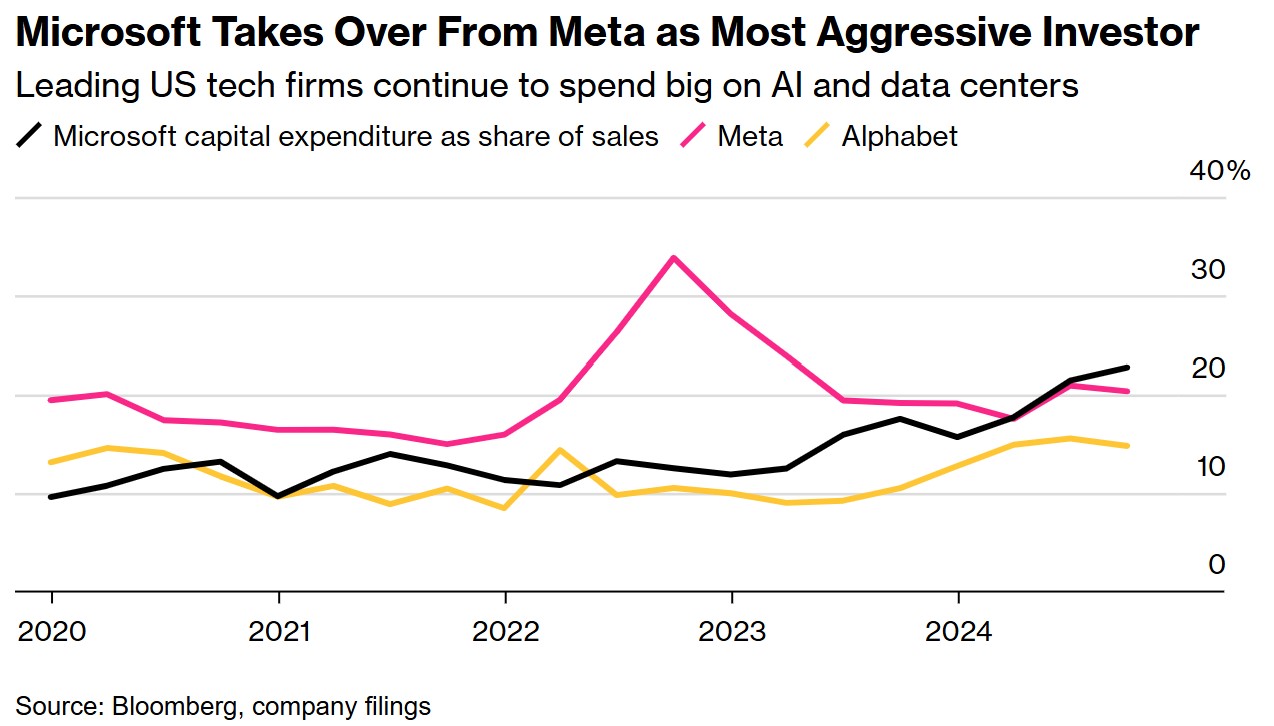

Microsoft Corp. (NASDAQ: MSFT) invested $20 billion in AI during the latest quarter. Bloomberg points out it overtook Meta Platforms Inc. (NASDAQ: META) in AI spending as a percent of revenue.

Investment budgets directed at AI exploded across the Big 4. Microsoft and Meta alone plan to spend over $80 billion between them this year on data centers and model building.

Investor’s moods, however, have shifted from “what AI can do eventually” to “what have you done for me lately.”

They want results to match prior promises.

And the results are mixed.

Microsoft is struggling to keep up with expectations. It beat on topline revenue, but cloud sales growth slowed from the prior quarter (from 35% to 34% growth). Markets punished the stock, opening down 4% after the earnings release.

On the other hand, Alphabet Inc. (NASDAQ: GOOG) delivered results, and the stock, at last check, was up 7.4% since earnings came out on Tuesday.

Now, results versus expectations play a big role in these price moves. And there’s a game to be played pitting Street estimates against results. But factors like earnings beat and revenue growth show only what’s on the surface.

Guess what?

The market doesn’t care what’s on the surface. Anyone can see that.

It cares about competitive profits.

You have to look deep below the surface to see the difference between Alphabet’s and Microsoft’s competitive profits.

Only then can you justify the price.

Below the Surface

Last quarter, Microsoft generated $65.6 billion in revenue compared to Alphabet’s $88.3 billion.

They generated that revenue on nearly identical capital bases—$351 billion for Microsoft and $355 billion for Alphabet.

That capital isn’t free. Markets expect a minimum return on capital. And for Microsoft and Alphabet, that is just over 9.5% for each company.

So, after stripping out operating expenses and a 9.5% cost of capital, Microsoft generated $16.9 billion in competitive profits last quarter and Alphabet $18.7 billion.

Divide that profit by sales, and you get a competitive profit margin to see which company delivers the highest competitive profit relative to sales.

You can see below that, on that score, Google wins. It earns more on its capital, so its competitive profit margin is much higher.

Markets care about that margin. A big and positive competitive profit margin is an excellent indicator of long-term profits.

Over the short term, however, how quickly those profits grow matters more.

Alphabet grew competitive profits at 6% compared to Microsoft’s 1.3%. Moreover, Alphabet has consistently increased that growth rate over the last few quarters, while Microsoft’s growth rate is declining.

And what you saw this week with Google’s stock price was the market’s reward for growing competitive profits at higher rates while Microsoft’s stock got punished.

That’s how markets hold capital to account. They reward companies that get more out of their capital quarter after quarter and punish those that can’t get their capital to work.

Now that we know how these two companies’ competitive profits compare, we need to know how much profits need to grow to justify current stock prices.

At $171 for Google and $412 for Microsoft, the chart below shows that Google has a far lower growth rate priced into its stock.

Google’s competitive profits must grow at 4.2% to justify paying $171 for its stock. This is lower than its current growth rate and not an unreasonable expectation given its upward trajectory.

To justify Microsoft’s $412 stock price, however, competitive profits must grow at 10.2%, far higher than the 1.3% it grew profits last quarter. A growth rate that looks like it could soon turn negative.

By this measure, Google is priced at a discount while Microsoft fetches a premium. And there are two ways to read that premium.

You can read Microsoft’s premium as the market expects more growth from Microsoft going forward and for Google to slow down.

The other view is one of mispricing for any number of reasons. Google could get broken up for being an “illegal monopoly” after all, which would hamper its scale and ability to deliver 20% margins.

However you read it, you can see how it helps to look below the surface to know what you paying for when you buy a stock.

Think Free. Be Free.

Don Yocham, CFA

Managing Editor of The Capital List

Related ARTICLES:

American Exceptionalism, v2.0

By dustin

Posted: February 12, 2025

The Holy Trinity of Growth

By dustin

Posted: February 7, 2025

The War for the American Way

By dustin

Posted: February 7, 2025

Draining the Moat

By dustin

Posted: February 2, 2025

Deep-Sixed AI Dreams

By dustin

Posted: January 28, 2025

From FUD to Oil and Gas Clarity

By dustin

Posted: January 25, 2025

Waking Up to the “Drill Baby, Drill” Dream

By dustin

Posted: January 22, 2025

This Ain’t Your Mother’s Internet Bubble

By dustin

Posted: January 21, 2025

Tariff Winners and Losers

By dustin

Posted: January 17, 2025

The Odds Favor Growth

By dustin

Posted: January 14, 2025

FREE Newsletters:

"*" indicates required fields