Getting AI to Hyperscale

I’ve often discussed with you the bottlenecks that tech companies must clear to fulfill their AI dreams.

The most immediate hurdle to growth is supplying power to energy-intensive models. Clearing this hurdle requires new transmission lines, building traditional natural gas-fired power plants on site, and going nuclear.

Sufficient data to train models has rapidly become another near-term growth limiter. AI needs human-generated data to train models. However, AI-generated content already exceeds 57% of all internet content, and that flood of AI data makes it exceedingly expensive to train new models.

For instance, the earliest public version of ChatGPT (GPT-3) cost between $5 and $10 million to train, while GPT-4 exceeded $100 million.

The cost of training the next model upgrade, codenamed GPT-5 Orion, has exceeded half a billion dollars. It is months behind schedule and still not ready for release.

These obstacles will not deter Big Tech, however. In fact, they’re going bigger as they shift from large-scale data centers to hyperscale.

AI capital budgets surged from an annual rate of $80 billion early last year to $200 billion by the third quarter and will likely approach $300 billion later this year.

But this hyperscaling— packing as many chips as closely as possible—exposes yet another bottleneck to AI growth.

And busting through that limit means massive profits for one company in particular.

Back-End Connections

As AI chip clusters grow, the connections between chips grow exponentially.

A 25,000-chip cluster requires 75,000 connections, or 3 times as many connections as chips.

Increase the number of chips in a cluster to 1,000,000—this won’t happen within the next year, but they will get there—and the number of connections leaps to 10,000,000 (or 10 times as many connections as chips).

The network of connections becomes massive, thereby driving demand for networking chips that ensure all those Nivida Blackwell chips—at $70,000 each—never sit idle.

And that’s where Arista Networks (NYSE: ANET) comes in.

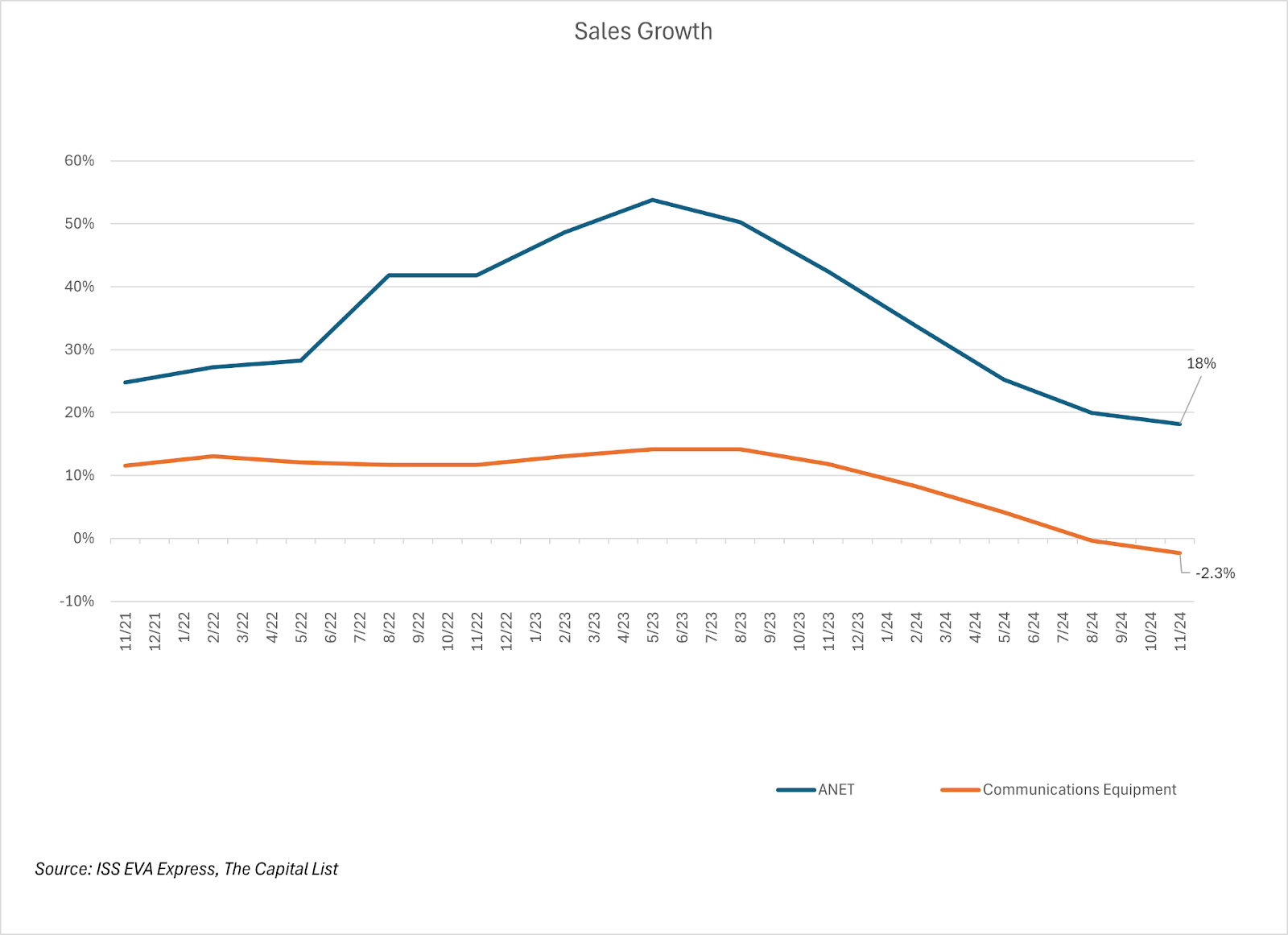

It’s a strong competitor in the space, generating an 18% increase in sales, while the average communications equipment company has seen sales decline 2.3% over the past year.

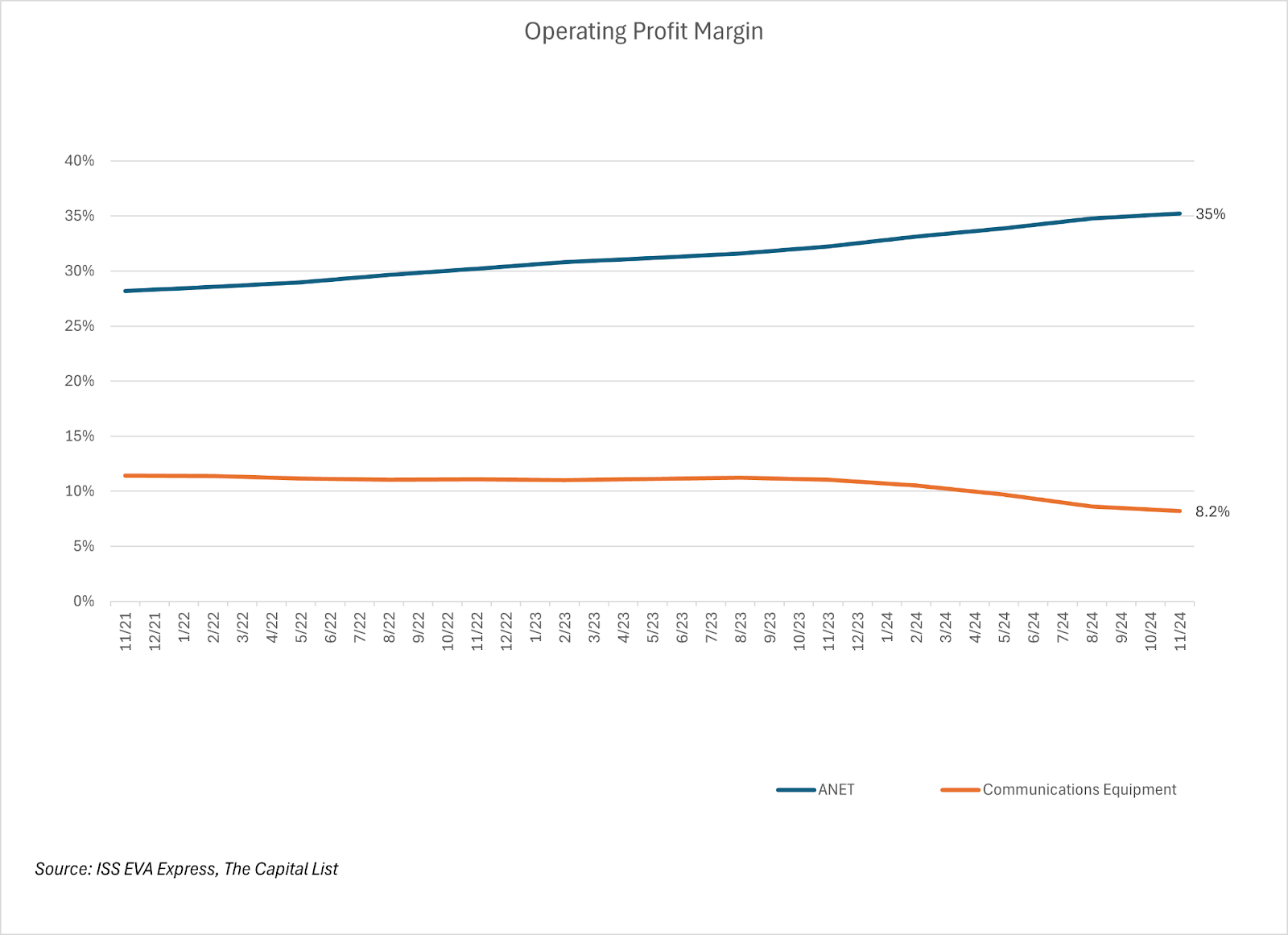

It also boasts fat operating profit margins of 35% compared to its sub-industry.

But, as is always the case, sales and operating profits mean nothing when a company can’t also outperform the capital it used to generate them.

And that’s where Arista Networks shines.

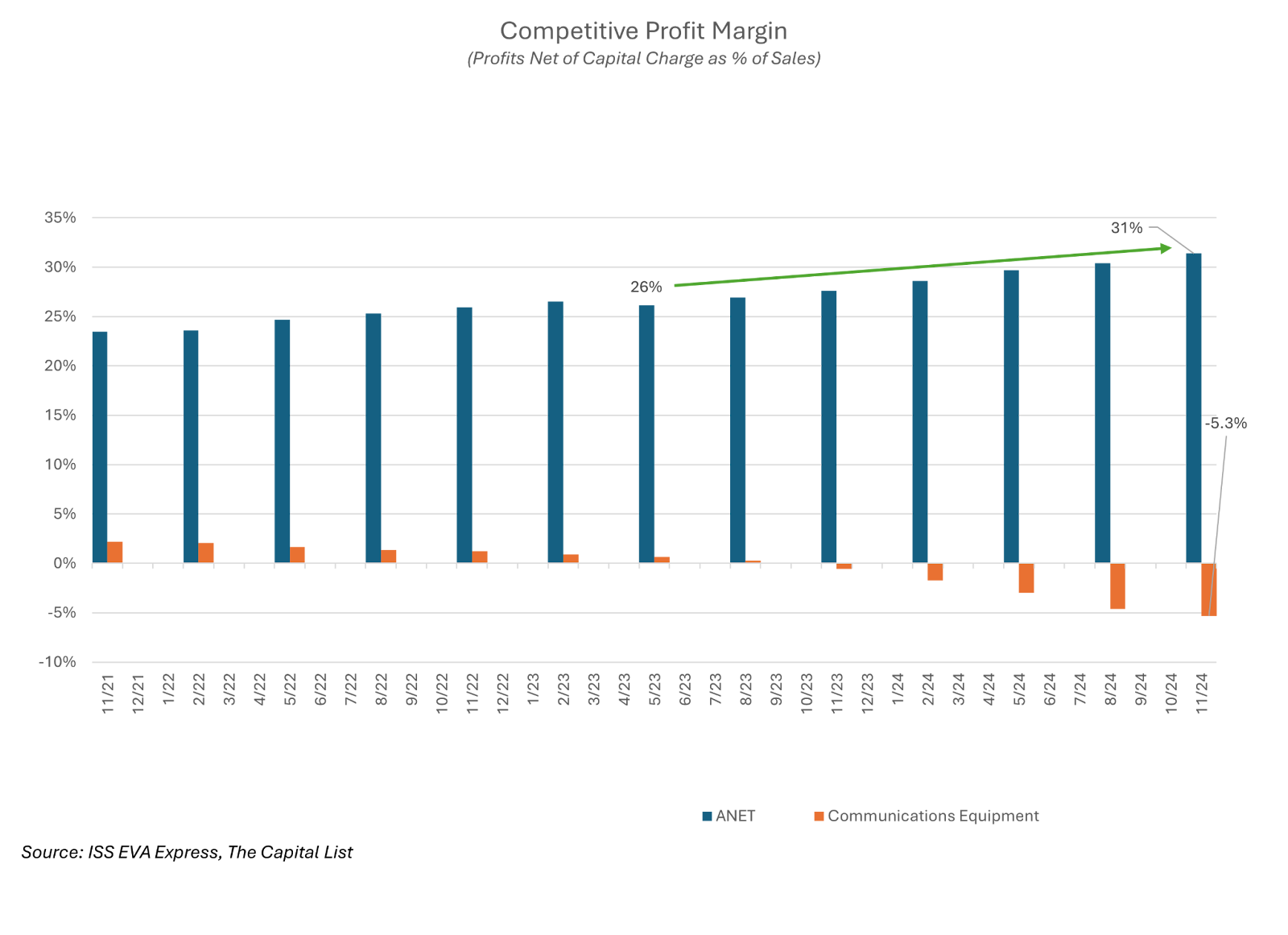

Competitive profits, or the amount by which operating profits exceed capital costs, drive stock prices higher over time. And doing so consistently at an increasing rate creates the ultimate boost.

Over the last several quarters, Arista’s management has increased competitive profits from 26% of sales to 31%. Meanwhile, the losses have piled up for its competitors.

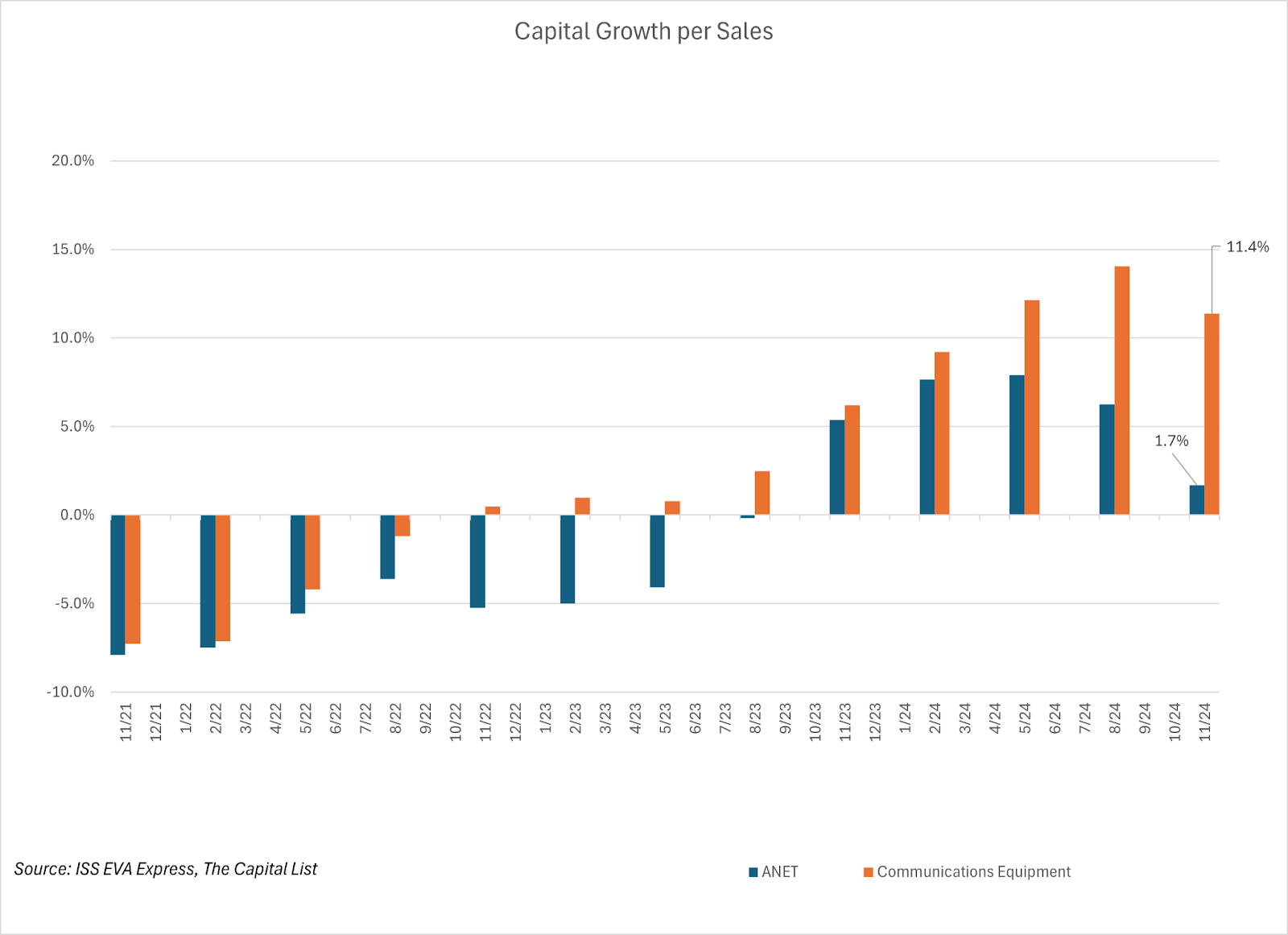

That widening advantage is partly due to declining competitor sales. However, a more significant driver of the diverging profitability is that the competition has invested heavily in catching up.

They just can’t make those investments pay.

I’ll break down more of the fundamentals driving Arista’s outperformance in my following Capital InFocus report.

You’ll have it by Friday. So keep an eye on your inbox.

Until then,

Think Free. Be Free.

Don Yocham, CFA

Managing Editor of The Capital List

Related ARTICLES:

American Exceptionalism, v2.0

By Don Yocham

Posted: February 12, 2025

The Holy Trinity of Growth

By Don Yocham

Posted: February 7, 2025

The War for the American Way

By Don Yocham

Posted: February 7, 2025

Draining the Moat

By Don Yocham

Posted: February 2, 2025

Deep-Sixed AI Dreams

By Don Yocham

Posted: January 28, 2025

From FUD to Oil and Gas Clarity

By Don Yocham

Posted: January 25, 2025

Waking Up to the “Drill Baby, Drill” Dream

By Don Yocham

Posted: January 22, 2025

This Ain’t Your Mother’s Internet Bubble

By Don Yocham

Posted: January 21, 2025

Tariff Winners and Losers

By Don Yocham

Posted: January 17, 2025

The Odds Favor Growth

By Don Yocham

Posted: January 14, 2025

FREE Newsletters:

"*" indicates required fields