Gensliger’s Out

I laid out in October the disaster unfolding at Intel Corp (NASDAQ: INTC).

The company began losing its competitive edge in 2018 when it started losing ground to TSMC. But when Pat Gelsinger took over in 2021, he turned a competitive struggle into a full-blown dumpster fire.

He led Intel away from high-value chip design by plowing billions into low-value commodity manufacturing for other chip designers.

It was a disastrous move.

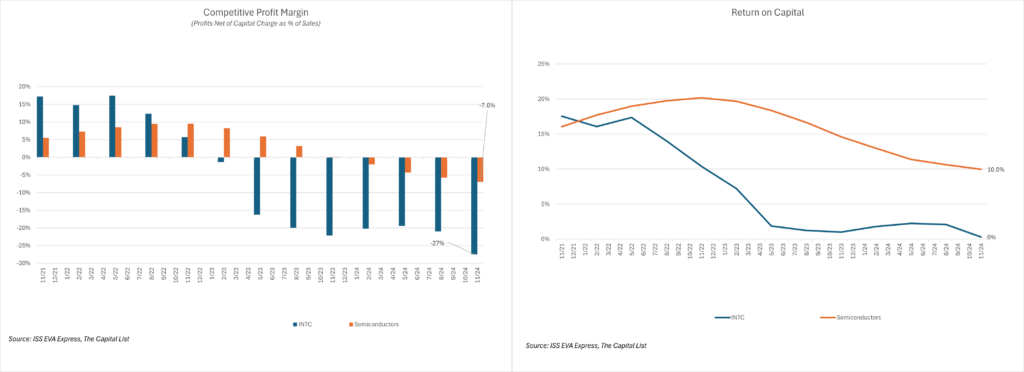

Profitability collapsed. Competitive profits as a percentage of sales went from over 15% in 2022 to a loss of 27%, and the company generates no return on the capital Gelsinger has invested to move Intel down the value chain.

Well, Gelsinger is out. He resigned with no clear successor in place. But no matter who takes the reins, the hole he dug for Intel could take years to correct.

The stock was trading around $25 when I shared my Capital InFocus report on Intel with a near-term price target of $18.

It now trades at $21.

Here’s how low it could go.

A $130 Billion Hole

As of Intel’s latest financial report published at the end of October, it generated $54.2 billion in revenue over the last year.

To determine whether that revenue contributes positively to its stock price, I’ll take your from that revenue down through competitive profits because sustained competitive profits ultimately determine whether a company is worth more than just the value of its capital.

Intel’s $54.2 billion revenue barely covered its operating costs of $53.7 billion. Leaving a mere $521 million in after-tax operating profit (left chart).

It also took $163 billion in capital to generate that operating profit (right chart) for a 3.2% return on capital ($521 million divided by $163 billion). Over the same time frame, the average company (adjusting for Intel’s business risk and debt levels) would have returned 9.4%, or $15.4 billion operating profit, on that same capital base.

In other words, under Genslinger’s command, Intel’s capital underperformed the competition for a $14.9 billion loss.

Here’s the path from Intel’s revenue to competitive loss (left chart).

That single-year loss carried forward ultimately costs shareholders $157 billion. Deduct that total from Intel’s $163 billion capital base, and Intel is, fundamentally, worth $6.1 billion.

Intel’s market value at $21 per share is $136.8 billion, a massive premium to its $6.1 billion fundamental value.

Whoever takes over for Gelsinger must somehow figure out how to turn around the company and fill that $130.6 billion gap with future competitive profits—at least for Intel to be worth $21 per share.

They won’t. At least not anytime soon.

Wall Street has Intel’s sales growing 19% on average over the next five years to $74.4 billion, with cash operating costs falling by 20%.

Unfortunately, that improved performance does little to substantially improve Intel’s competitive loss, given its large capital base. It remains basically unchanged over 5 five years, nudging higher from $14.9 to $14.7 billion.

That does nothing to fill the $130 billion gap between Intel’s fundamental and market value.

But a falling stock price will.

My $18 price target was a near-term target for Intel. Based on how it traded today, down $1.16 to $20.80, it could hit $18 by tomorrow.

Over time, given the substantial gap to fill, $10 doesn’t seem out of reach.

Think Free. Be Free.

Don Yocham, CFA

Managing Editor of The Capital List

Related ARTICLES:

AI Eating Itself

By Don Yocham

Posted: December 20, 2024

Tesla: The Ultimate Trump Trade

By Don Yocham

Posted: December 16, 2024

Markets Rising for a Reason

By Don Yocham

Posted: December 13, 2024

Gensliger’s Out

By Don Yocham

Posted: December 5, 2024

The Elemental Energy Link

By Don Yocham

Posted: November 21, 2024

Holding Capital to Account

By Don Yocham

Posted: November 1, 2024

Energy To Ride Out the Storm

By Don Yocham

Posted: October 30, 2024

Coming Down the Mountain

By Don Yocham

Posted: October 9, 2024

The Next AI Contender

By Don Yocham

Posted: October 2, 2024

The Price of Profits

By Don Yocham

Posted: September 27, 2024

FREE Newsletters:

"*" indicates required fields