From FUD to Oil and Gas Clarity

For the past four years, traditional energy stocks received no love from investors.

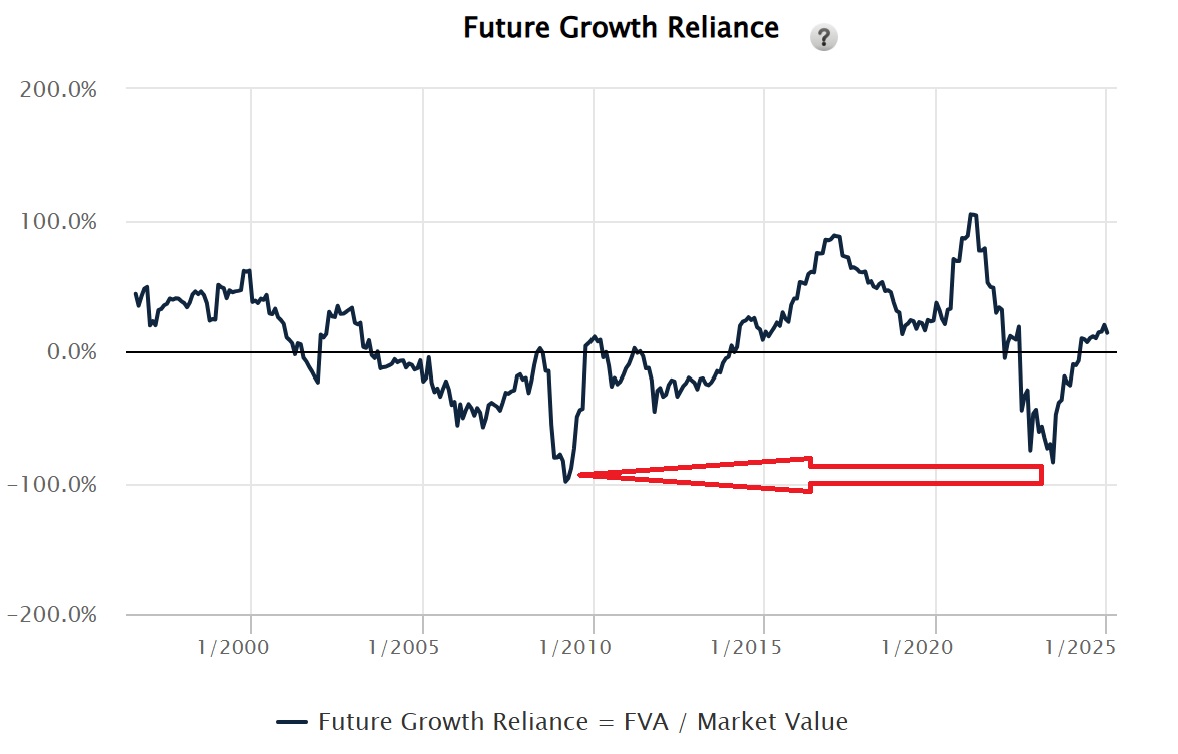

Green energy initiatives hamstrung oil and gas stocks with fear, uncertainty, and doubt, driving valuations down to levels last seen during the Great Financial Crisis of ‘09.

But the mood bottomed halfway through ‘23.

Booming power demand to fuel the rise of AI shed a harsh light on the reliability of solar and wind power. It proved the indispensability of hydrocarbons as a foundational energy source.

With Trump busy clearing the decks for energy companies to “Drill, Baby, Drill,” you can expect the euphoria that washed over AI-related plays over the past couple of years to spill into the energy sector and push valuations up to former heights.

Exploration and production companies can now confidently develop America’s vast proven reserves.

And the rush to develop oil and gas fields will put a bid under downtrodden energy services stocks like RPC Inc. (NYSE: RES).

The Energy Equipment and Services Sector

The energy equipment and services sector provides the tools, technologies, and expertise required to explore, extract, produce, and manage oil and gas resources.

Their operations span the entire energy supply chain, supporting upstream activities (exploration and production) and midstream operations (transportation and storage). These companies enable energy producers to access increasingly complex reservoirs, improve extraction efficiency, and maintain well productivity over time.

Key segments of the sector include:

Drilling Services: Focused on well construction, companies in this segment provide advanced rigs, automated systems, and directional drilling technologies to access both onshore and offshore reservoirs.

Completion and Production Services: These services optimize well performance after drilling is complete. Hydraulic fracturing, cementing, and artificial lift systems are common solutions to enhance recovery rates from reservoirs.

Maintenance and Intervention Services: Wells require continuous maintenance to remain productive. Services such as coiled tubing, snubbing, and wireline operations help address technical challenges, conduct workovers, and extend the productive life of wells.

Equipment Manufacturing: This includes the design and production of critical tools and systems, such as pumps, valves, and control systems, that are essential for oil and gas operations.

The sector is highly cyclical and sensitive to oil and gas prices. Rising energy prices and increased exploration activities drive demand for these services, while low prices and production cutbacks can lead to reduced activity and intense competition.

RPC Inc.: Competitive Position in the Sector

RPC Inc. (NYSE: RES) is a leading provider of specialized oilfield services and equipment, primarily focused on supporting upstream exploration and production activities. The company operates through two primary business segments: Technical Services and Support Services.

Core Strengths:

Focused Expertise: RPC specializes in well completion and production services, particularly hydraulic fracturing, coiled tubing, and pressure pumping. Its targeted approach allows the company to deliver efficient and tailored solutions to its clients.

Diverse Service Offerings: The company provides a wide range of services that span well completion, stimulation, and intervention. This diversity positions RPC to capture demand across various stages of the well lifecycle.

Geographic Presence: RPC has a strong presence in key U.S. shale basins, including the Permian Basin, Bakken, and Eagle Ford. These areas represent some of the most active and productive oil and gas regions in the country.

Lean Operating Model: The company’s focus on operational efficiency and cost control enables it to remain competitive, even during periods of industry downturn.

Market Challenges:

Exposure to Volatility: Like other players in the sector, RPC is vulnerable to oil and gas price fluctuations. Reduced exploration and production activity during downturns directly impact demand for its services.

Competition: RPC operates in a highly competitive space alongside larger rivals, including Halliburton, Schlumberger, and Baker Hughes, which have greater scale and resources.

Opportunities:

Recovery in Oil Prices: The recent recovery in oil prices has spurred increased drilling and completion activity, particularly in U.S. shale basins, providing a tailwind for RPC’s services.

Technological Advancements: RPC’s investments in advanced technologies, such as enhanced hydraulic fracturing techniques and real-time monitoring, help differentiate it from competitors and improve operational outcomes for its clients.

Consolidation Opportunities: The fragmented nature of the sector offers potential for strategic acquisitions or partnerships to expand market share and geographic reach.

RPC Inc. occupies a competitive niche within the energy equipment and services sector, with a strong focus on well-completion and production services in key U.S. shale plays.

I’ll break down the fundamentals of RPC Inc. in my next Capital InFocus report for you this week.

Keep an eye on your inbox.

Until then,

Think Free. Be Free.

Don Yocham, CFA

Managing Editor of The Capital List

Related ARTICLES:

American Exceptionalism, v2.0

By Don Yocham

Posted: February 12, 2025

The Holy Trinity of Growth

By Don Yocham

Posted: February 7, 2025

The War for the American Way

By Don Yocham

Posted: February 7, 2025

Draining the Moat

By Don Yocham

Posted: February 2, 2025

Deep-Sixed AI Dreams

By Don Yocham

Posted: January 28, 2025

From FUD to Oil and Gas Clarity

By Don Yocham

Posted: January 25, 2025

Waking Up to the “Drill Baby, Drill” Dream

By Don Yocham

Posted: January 22, 2025

This Ain’t Your Mother’s Internet Bubble

By Don Yocham

Posted: January 21, 2025

Tariff Winners and Losers

By Don Yocham

Posted: January 17, 2025

The Odds Favor Growth

By Don Yocham

Posted: January 14, 2025

FREE Newsletters:

"*" indicates required fields