Capital Won the Election

The uncertainty meter dropped dramatically yesterday.

Trump’s overwhelming election victory gave markets some much-needed clarity.

That clarity was still driving the S&P 500 to all-time highs as of this writing earlier today. From Monday’s close, the day before elections, the S&P was up over 4%.

Green energy mandates will no longer throttle energy investment. Falling tax rates will free up cash for spending and investment. And businesses expect a steep reduction in overbearing, competition-killing regulations.

In short, capital was the big election winner.

Now, that doesn’t mean the markets still don’t face tremendous headwinds.

Valuations for S&P 500 companies continue to press higher into unsustainable territory. Over 47% of the S&P’s now 6,000-plus value relies on future growth in competitive profits.

And, with inflation expectations up 76 basis points since the Fed cut rates in September, markets can no longer rely on lower rates to propel valuations higher.

Inflation Expectations as measured by the difference between traditional (nominal) treasuries and inflation-protected (real) treasuries.

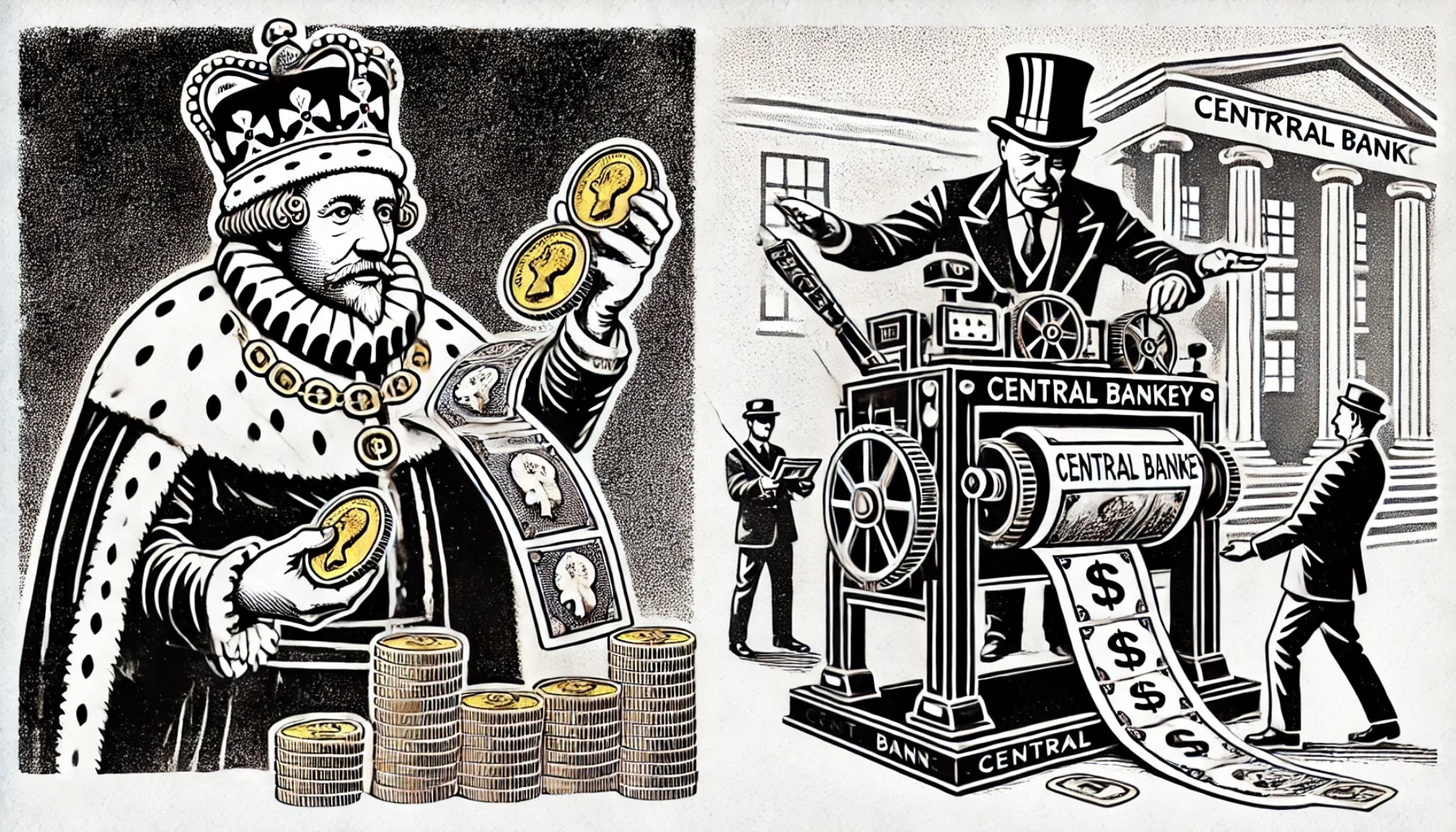

The game has changed for the Fed. BRICS are calling it quits on the petro-dollar system. The end of the U.S. dollar’s privileged position over the last 80 years makes it harder for the Fed to count on exporting inflation to support expansionary monetary policies.

But with capital in a more favored position, the rise in the supply of capital will keep capital costs lower (at least relative to inflation) and stock market valuations higher.

In short, we could ultimately achieve a low-rate environment without the Fed getting in the middle.

There’s a lot that factors into that low-rate hypothesis. We must somehow clear a lot of Federal debt on which interest expense recently exploded.

We can grow our way out. But that depends on government downsizing and deficit reduction. That’s more likely now based on Trump’s agenda, but far from certain.

Inflation could also solve the problem (higher inflation reduces the real value of the debt and interest). And inflating debt away has historically been the chosen path.

My long-term bet is for a bit of both. Plus, a heaping dose of disruption.

With the AI race showing some early winners, it’s important to get on the side of the disruptors.

With that in mind, here are a couple of stocks emerging on the winning side…

Related ARTICLES:

AI Eating Itself

By dustin

Posted: December 20, 2024

How To Keep This Market Moving

By dustin

Posted: December 11, 2024

Crushing the Competition

By dustin

Posted: December 3, 2024

Nvidia: The Only Game in Town

By dustin

Posted: December 3, 2024

The Pilgrims Guide to Voluntary Slavery

By dustin

Posted: November 27, 2024

Who Pays for Trade

By dustin

Posted: November 8, 2024

Capital Won the Election

By dustin

Posted: November 7, 2024

A New Game Just Like the Old Game

By dustin

Posted: October 20, 2024

The Cost of the Dollar Status Quo

By dustin

Posted: October 15, 2024

Capital Components

By dustin

Posted: September 25, 2024

FREE Newsletters:

"*" indicates required fields