Market Chaos and AI Gold

No doubt, investors have plenty of reasons to be nervous.

Economic growth and inflation have apparently hit an inflection point, hinting at an end to the gangbuster bull market that began in October 2022.

Israel and Iran inch ever closer to all-out war, threatening a regional conflict in which the U.S. can’t avoid involvement. Meanwhile, Ukraine/Russia and Taiwan/China linger in the background.

In less than 90 days, the most tension-filled election we have ever experienced promises radically different visions for the future of American policy—with the stark possibility that neither side will accept a loss.

And, earlier this week, a mere 25 basis point rate hike from the Bank of Japan sparked a global stock market rout, reminding the world that contagion can rear its ugly head at any time.

But over my 30-year career in capital markets, I’ve lived through more than a few fragile markets. That time has taught me that any environment, whether bull, bear, panic, euphoria, or sideways, presents opportunities.

Provided you don’t let the emotions driving the markets blind you to what’s going on under the surface.

Unfazed

To be sure, markets face significant headwinds.

Those headwinds could take markets much lower from here—though not guaranteed.

In any case, whatever the next few months hold in store, under the veil of fear currently shrouding markets lies the same powerful dynamic reshaping every aspect of the economy – the relentless advance of AI.

I know, that’s no longer a headline issue. The market’s attention lies elsewhere. But I’ll tell you who isn’t distracted by the current market fragility – Big Tech.

Microsoft, Google, Meta, and Amazon will each invest around $40 to $50 billion in data centers over the next year to build out their capacity to deliver AI solutions.

To put that in context, $50 billion is as much capital as Saudi Aramco, the world’s largest oil company, invests in its business, while Exxon Mobil and Chevron combined will be hard-pressed to spend that much.

Data is the new oil. In fact, it’s bigger.

Moreover, that investment is not contingent on a strong market or economy. Their massive cash hoards make their capital spending goals virtually recession-proof.

Plus, lower stock prices put them in a position to scoop up AI start-ups at a discount.

And it gives you a second chance to build positions in stocks that will power the future of AI.

Specifically, NVIDIA Corp. (NYSE: NVDA).

Expensive, but Worth It

Since May of last year, NVDA has turned the semi-conductor industry on its head.

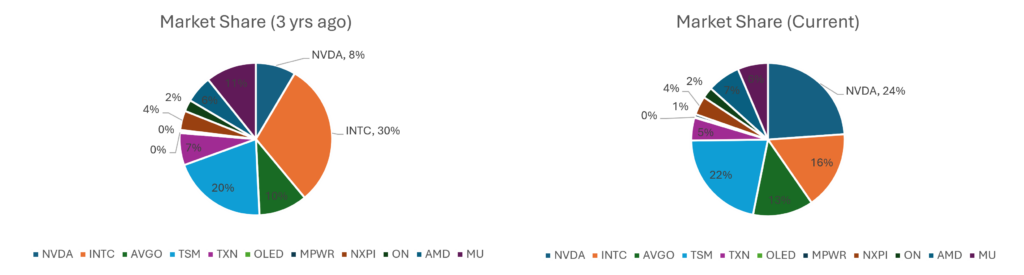

Three years ago, Intel Corp. (NASDAQ: INTC) led semiconductor sales with a 30% market share among the top twelve semiconductor companies globally.

At the time, NVDA ranked 5th, behind Micron Technology (NASDAQ: MU).

NVDA now dominates the sector with a 24% share, while the market share of its competitors either stagnated or declined.

Source: ISS Investor Express, The Capital List

Even in light of NVDAs ability to capture the lion’s share of AI chip sales, the 346% rally in its stock price from May 2023 to June 2024 seemed extreme.

It was. But so, too, is the opportunity for AI to reinvent life as we know it.

With NVDA’s pullback—down 25% off its $140 peak—investors now have a second chance to build a position in a stock at the center of this transformational opportunity.

NVDA’s stock price is still rich. It could get cheaper.

But that’s just a short-lived reflection of what’s going on at the surface.

To see what’s going on below, check out my latest Capital InFocus report on NVIDIA.

Want more Big Picture perspective? Join The Capital List here.

Think Free. Be Free.

Don Yocham, CFA

Managing Editor of The Capital List

Related ARTICLES:

American Exceptionalism, v2.0

By Don Yocham

Posted: February 12, 2025

The Holy Trinity of Growth

By Don Yocham

Posted: February 7, 2025

The War for the American Way

By Don Yocham

Posted: February 7, 2025

Draining the Moat

By Don Yocham

Posted: February 2, 2025

Deep-Sixed AI Dreams

By Don Yocham

Posted: January 28, 2025

From FUD to Oil and Gas Clarity

By Don Yocham

Posted: January 25, 2025

Waking Up to the “Drill Baby, Drill” Dream

By Don Yocham

Posted: January 22, 2025

This Ain’t Your Mother’s Internet Bubble

By Don Yocham

Posted: January 21, 2025

Tariff Winners and Losers

By Don Yocham

Posted: January 17, 2025

The Odds Favor Growth

By Don Yocham

Posted: January 14, 2025

FREE Newsletters:

"*" indicates required fields