Trump’s Tariff Threats and Inflation

Welcome to 2025.

Hopes run high among investors that two years of 20%-plus gains for the S&P will lead to a third.

And with the market frenzy making a quantum leap to quantum computing stocks, there’s plenty of tinder to fuel a continuation of last year’s remarkable rally.

The economy is cooperating, too.

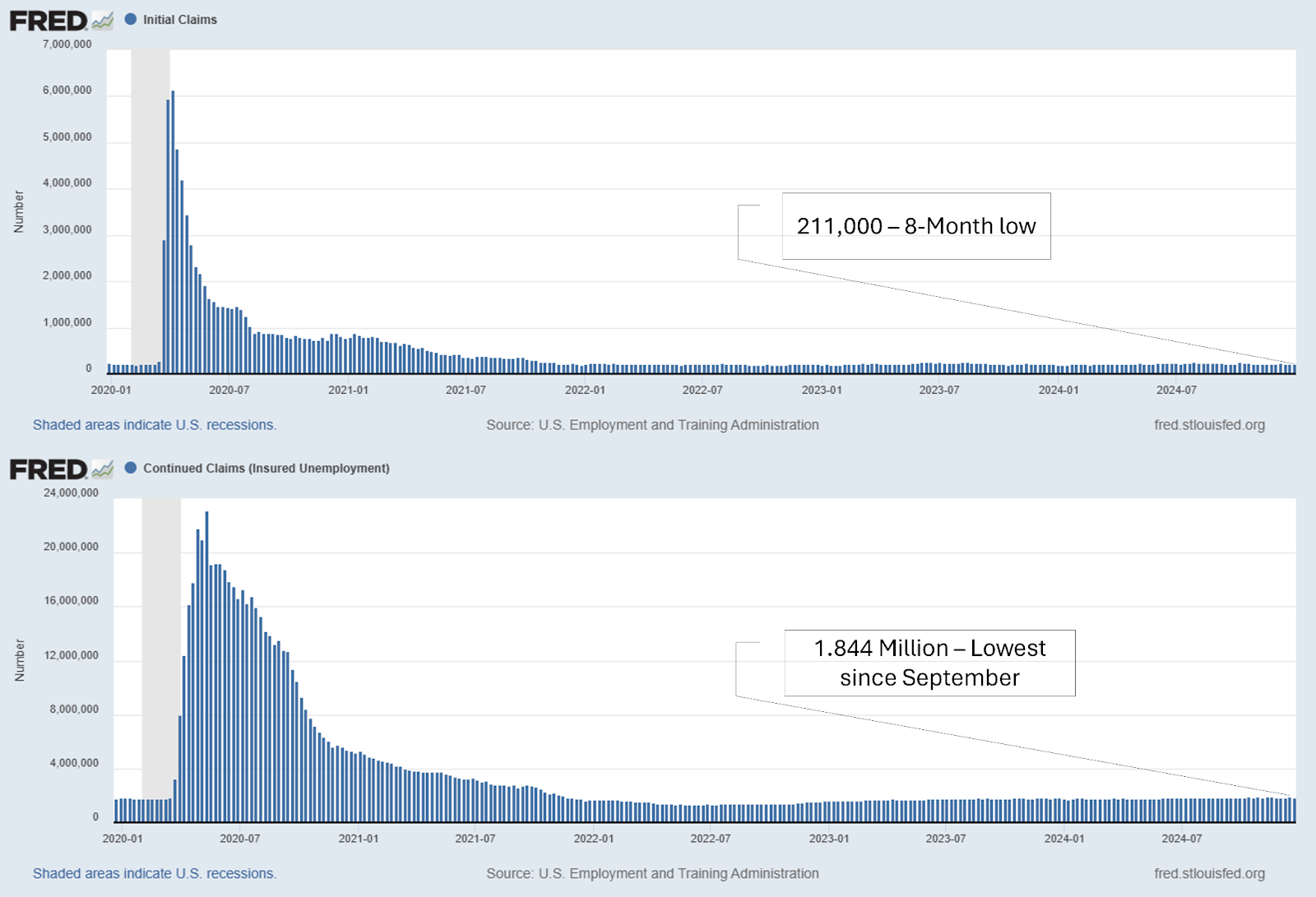

Unemployment insurance claims, both new and ongoing (labeled initial and continuing below), remain well contained at levels that suggest employment remains strong.

Businesses have also put AI to work leading to significant gains in productivity.

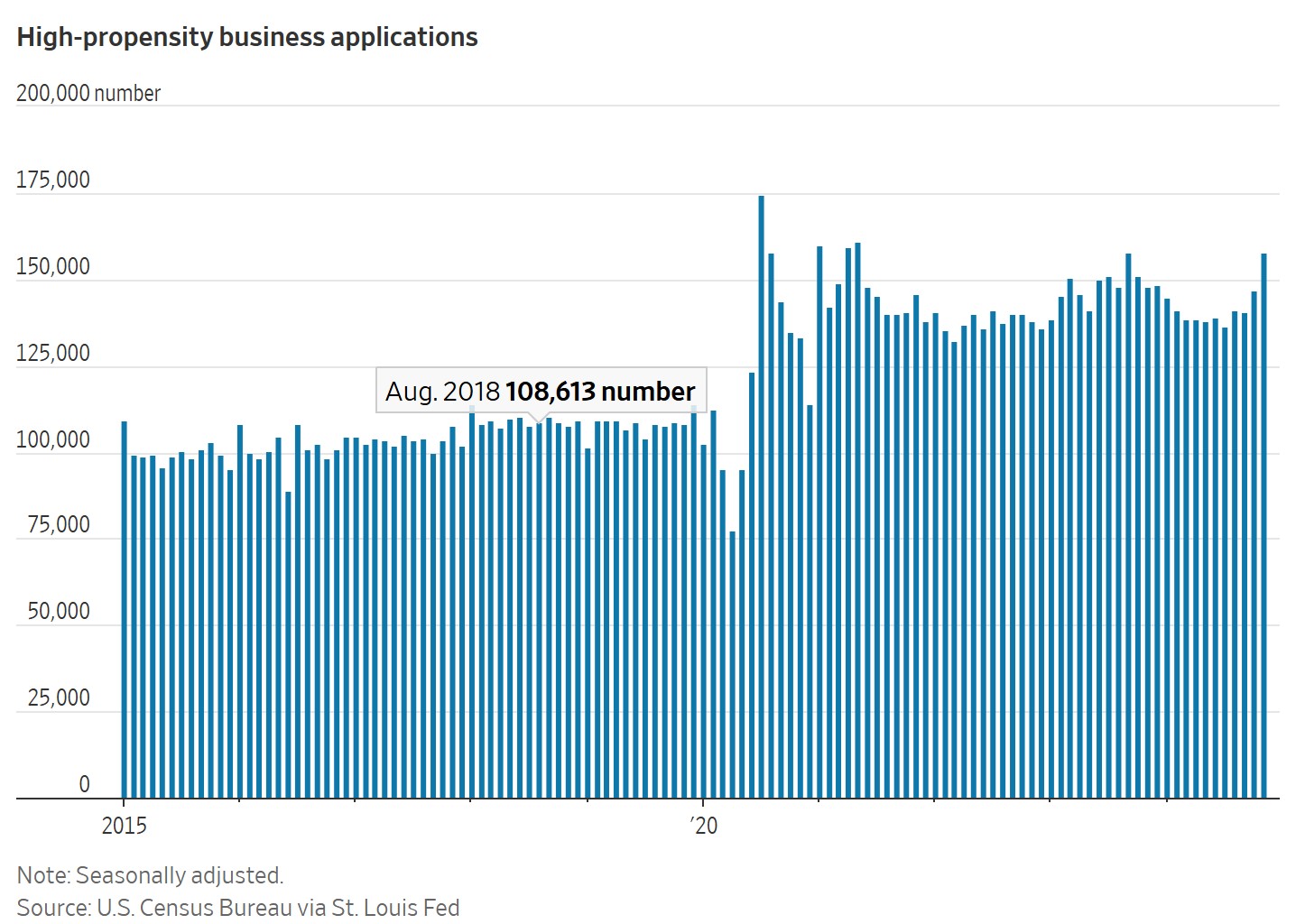

And the pace of new business formation by entrepreneurs with a high likelihood to succeed warms my capitalist heart.

Source: Wall Street Journal

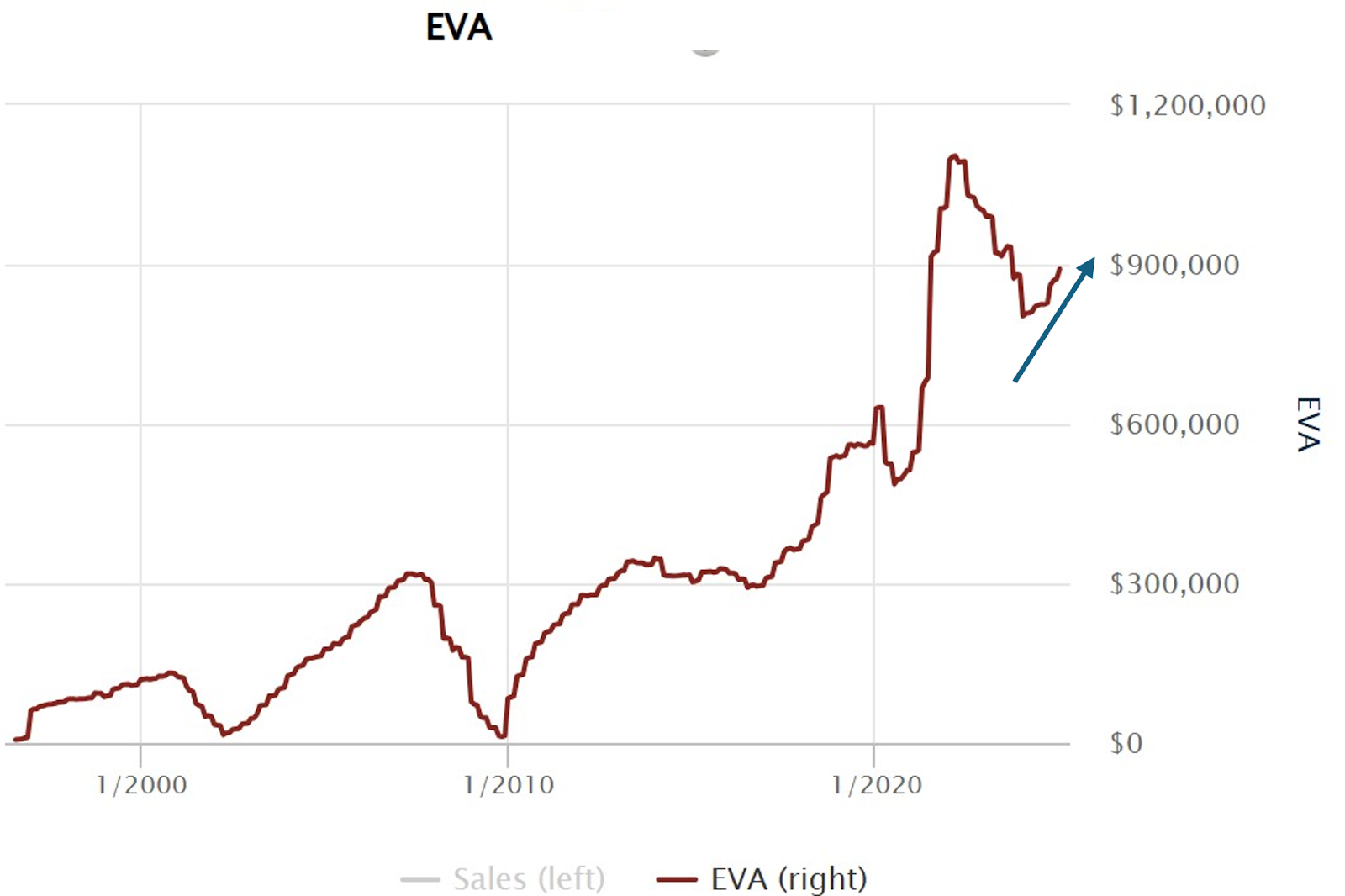

That’s not to say that markets don’t face headwinds. Stock valuations remain near all-time highs. However, rising competitive profits for S&P 500 stocks provide a path for companies to grow into their valuations.

Source: ISS Investor Express

Trump’s tariffs could also unsettle markets. Unravelling decades of multilateral trade agreements orchestrated through the World Trade Organization creates an unpredictable mess of winners and losers.

“Professional economists” believe tariffs lead inexorably to inflation . But I ignore their opinions. Decades in the markets have proven to me that economists can’t think past the dusty textbooks crowding their bookshelves.

When I want a clear perspective, I look at the biggest information processing machine on the planet—capital markets.

And here’s what they have to say about whether Trump’s Tariff Threats will lead to inflation.

The Threats

Currency and bond markets (which are just an extension of currency markets) tell a story about inflation expectations.

But before we look at what they’re saying about the implications of Trump’s Threats, let’s look at the threats he has made.

Here’s what I know:

- Universal Tariff: A baseline tariff ranging from 10% to 20% on all imported goods entering the United States.

- China-Specific Tariff: An additional tariff of 60% on goods imported from China, targeting trade practices and economic policies deemed unfair by the Trump administration.

- Tariffs on Mexico and Canada: A 25% tariff on all products imported from Mexico and Canada intended to pressure these countries into taking more decisive measures against illegal immigration and drug smuggling into the U.S.

These policies threaten to disrupt supply lines. Shortages and surpluses that markets can’t easily redistribute will occur, leading to higher prices. However, markets will eventually redistribute them, and the shortage premium will disappear.

And capital markets agree.

What Markets Say About Inflation

Currencies appreciate when interest rates are high or expected to rise relative to inflation. The currency with the most attractive level/change/inflation combo attracts foreign borrowers looking to earn high real returns, or returns after inflation.

And the dollar is appreciating relative to other currencies.

The chart below shows the Dollar Index – which tracks the performance of the U.S. Dollar compared to a basket of currencies weighted by trade.

The yellow line highlights the roughly 8% move since the end of September.

Source: TOS

Running through some individual countries included in the index, the Aussie Dollar, British Pound, Canadian Dollar, and Euro are down over 8% during that same time frame. Only the Japanese Yen has traded higher. I won’t drag you through the why. Just know that the Bank of Japan is a bag of cats that backed away from the cliff’s edge, so markets are simply relieved.

In any case, concerning the dollar, you can say that whatever higher prices result from tariffs, investors currently expect to earn a premium to inflation in the U.S. that trumps (ha! What a pun!) what they could earn in other countries.

Bonds tell the same story.

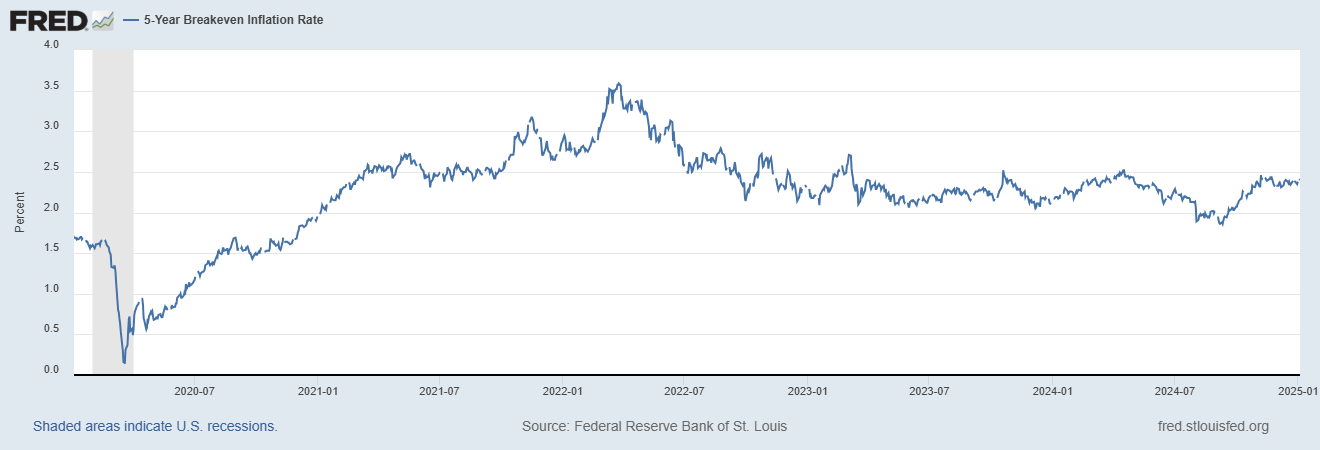

You can tease how much inflation bond markets expect by subtracting the yield on inflation-indexed bonds (bonds that pay coupons linked to inflation) from typical treasury bond yields. Markets price in the expected inflation rate, meaning investors will breakeven on returns

The chart below shows inflation expectations over the next 5 years of 2.41%.

That’s hardly a barn-burning inflation rate.

These signals represent an average estimate for inflation, which is like an over-under. It could be higher. And I’d take the over. But economic growth driven by the scramble to invest in a U.S. economy booming on the back of a return to small government, free market principles will more than compensate for the inflation we can expect from tariffs.

Think Free. Be Free.

Don Yocham, CFA

Managing Editor of The Capital List

Related ARTICLES:

Reshoring, Innovation, and Power: America’s Economic Transformation

By Don Yocham

Posted: March 4, 2025

From Enforcer to ATM: America’s Leadership Crisis

By Don Yocham

Posted: February 14, 2025

American Exceptionalism, v2.0

By Don Yocham

Posted: February 12, 2025

Tariff Winners and Losers

By Don Yocham

Posted: January 17, 2025

Trump’s Tariff Threats and Inflation

By Don Yocham

Posted: January 5, 2025

Adjusting to the Fed’s New Reality

By Don Yocham

Posted: November 15, 2024

Energy To Ride Out the Storm

By Don Yocham

Posted: October 30, 2024

FREE Newsletters:

"*" indicates required fields