Nvidia: The Only Game in Town

Just a short update for you on Nvidia Corp. (NASDAQ: NVDA).

I’ll keep it high-level today and will have an updated Capital InFocus report for you next week.

I first laid out the opportunity to own this most essential AI company in September when the stock was trading around $108. My original Capital InFocus report walked you through the fundamentals that I felt put the $140 price for the stock easily within reach.

It has since surged past $150, though it gave up some of those gains over the last couple of days and is now trading at $136. With that tremendous run behind us and last week’s earnings release, it’s time to dive in again for an updated look at the company’s performance.

Profits doubled at what is once again the world’s most valuable company. Microsoft, Google, Meta, and xAI count among Nvidia’s customers. They are going all in on superclusters or server racks with 100,000 Blackwell chips (several times more powerful than previous chips).

And with a backlog of over 12-months, consensus estimates of $185 billion in revenue over the next year look well within reach.

Data Center Revenue more than doubled to a record $30.8 billion and now accounts for over 85% of total revenue.

Nvidia shipped 13,000 samples of its new Blackwell AI chip last quarter, which are now in full production. Reports of overheating caused some concern, but they have since been addressed.

Supply chain issues are the only real hurdle to Nvidia hitting revenue targets. But the 12-month backlog in orders shows that their Blackwell chips are the only game in town.

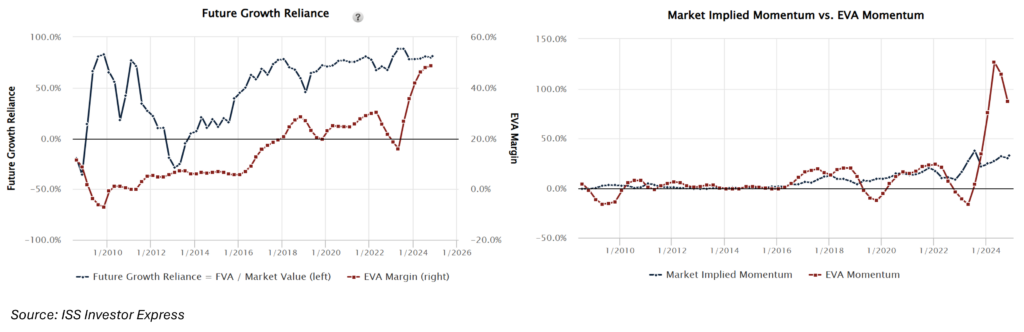

Despite the 25% rally from September, valuations based on Future Growth Reliance remain at 80%. Competitive profit margins (EVA Margins) increased to compensate for the higher price. And though the profit growth rate has slowed (EVA Momentum), they are still growing at a stunning 87% over the prior year.

Compare that 87% growth to the 32% growth rate required to justify the $136 price (Market Implied Momentum), and it’s clear Nvidia’s stock still has plenty of room to surprise on the upside.

I’ll have an updated Capital InFocus report ready for you in the next couple of days.

In the meantime, you can get up to speed on the long-term fundamentals of the company in this report.

You’ll hear from me soon.

Think Free. Be Free.

Don Yocham, CFA

Managing Editor of The Capital List

Related ARTICLES:

AI Eating Itself

By Don Yocham

Posted: December 20, 2024

How To Keep This Market Moving

By Don Yocham

Posted: December 11, 2024

Crushing the Competition

By Don Yocham

Posted: December 3, 2024

Nvidia: The Only Game in Town

By Don Yocham

Posted: December 3, 2024

The Pilgrims Guide to Voluntary Slavery

By Don Yocham

Posted: November 27, 2024

Who Pays for Trade

By Don Yocham

Posted: November 8, 2024

Capital Won the Election

By Don Yocham

Posted: November 7, 2024

A New Game Just Like the Old Game

By Don Yocham

Posted: October 20, 2024

The Cost of the Dollar Status Quo

By Don Yocham

Posted: October 15, 2024

Capital Components

By Don Yocham

Posted: September 25, 2024

FREE Newsletters:

"*" indicates required fields