Who Pays for Trade

“Consumption is the sole end and purpose of all production.” – Adam Smith

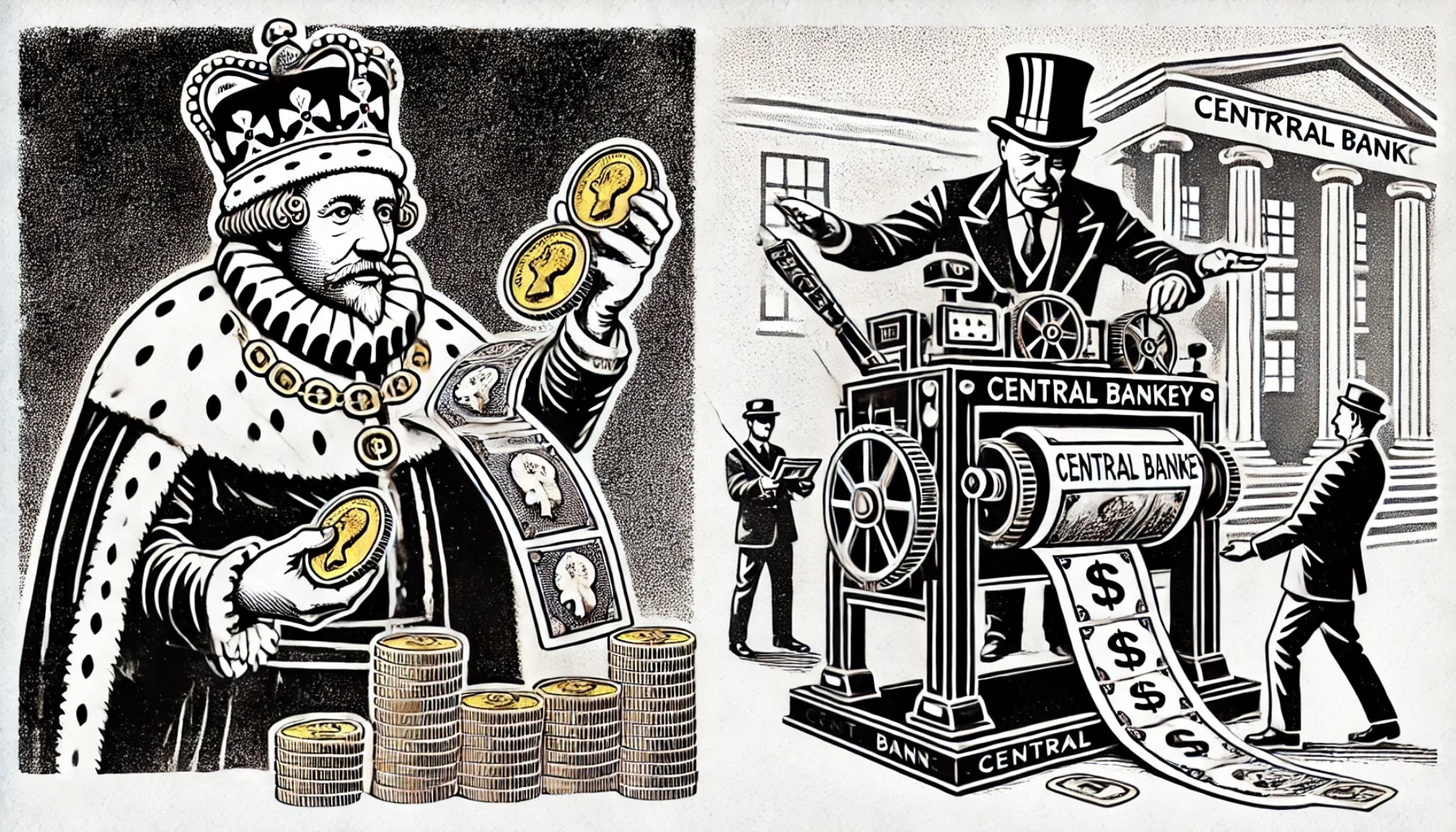

With Trump on deck, American’s are scrambling to understand his favorite word, “tarriffs.”

Shoe company Steve Madden illustrated that word in action this week in an analyst call revealing a drastic remodeling of supply lines to avoid tariffs on China.

Consequences like this should come as no surprise. But, sadly, how tariffs work in practice are as misunderstood as the exponential function.

“Who pays” is a billing question when they should be asking an economic one — “who bears the cost.”

To which I would say “everyone.”

Yes, Chinese companies will pay the bill. But that doesn’t mean they eat the cost.

How that cost gets passed on is as simple and complex as how a company chooses to pass on rising fuel prices. Which, like nearly all economic decisions, means weighing comparative advantage.

Elon Musk discussed comparative advantage in the context of tariffs on a recent Joe Rogan podcast (watch here at the 2:24 mark).

And how tariffs rebalances trade and feeds inflation based on shifting comparative advantage will be something all investors have to weigh now that Trump is in charge (we were heading that way anyway).

But comparative advantage answers another question too.

Namely, “will AI take everyones job?”

And the answer to that question is…

Simply the Best

Comparative advantage is typically used to explain why countries trade with one another. But it’s a far more fundamental concept than that because it explains why any of us bother to engage in economic transactions in the first place.

Let’s say you and I are neighbors, and we sell goods in our local village. We both make bread and beer, but your bread and beer are both absolutely better than mine.

You have an absolute advantage in producing both goods.

Does that mean I’m out of luck and you get all the business?

Absolutely not.

It’s a near certainty that you make more profit from either bread or beer. Assuming it’s beer, you’ll focus on brewing because that’s where you make the biggest profit. Leaving me an opportunity to bake and sell bread.

In this scenario, you have an absolute advantage in terms of quality for both goods but a comparative advantage in terms of efficiency with respect to beer. And your brewing edge creates my baking opportunity.

We both play to our relative strengths with comparative advantage dictating what we decide to produce.

Thus, a market is born.

Comparative advantage creates the conditions for differentiated production and trade, which evolves through competition.

Toss in the division of labor, and you now understand how the global economy works from the level of the sole proprietor and laborer to the scale of international trade.

It also explains why the freedom act in your best interest is the source of capitalism’s power.

And, to my way of thinking, comparative advantage provides a useful framework through which we can consider the implications of AI.

AI as Economic Agent

Think of AI as another player in the economic game. It has its strengths, and humans have theirs.

Compared to humans, the type of AI that ChatGPT represents can provide accurate, comprehensive responses across a broad domain of topics faster than any human can possibly hope.

Compiling information and even recommending solutions is the essence of ChatGPTs comparative advantage.

But, because “consumption is the sole and end purpose of production,” it still has to respond to human demand.

We, humans, will always be the end consumer. That is our comparative advantage. Whatever AI ultimately produces, it must be for our consumption.

We, humans, provide the ultimate limit to what AI will do.

Now, I’ve talked many times about AIs limits.

For starters, there’s the chips. Nvidia chips are the only game in town—but supply can’t meet demand.

Also, bottlenecks have formed around crucial equipment to run the data centers. And generating enough energy to run the AI models will throttle its growth for years.

AI is also running out of data to train more complex models. Feeding AI data from AI causes models to collapse. And, as early as next year, nearly all new data on the internet will be AI generated, which means AI will soon become its own limit.

And with basic economics as another limit to AIs reach, there will always be something for humans to do.

Humans are, and always will be the market.

Think Free. Be Free.

Don Yocham, CFA

Managing Editor of The Capital List

Related ARTICLES:

AI Eating Itself

By dustin

Posted: December 20, 2024

How To Keep This Market Moving

By dustin

Posted: December 11, 2024

Crushing the Competition

By dustin

Posted: December 3, 2024

Nvidia: The Only Game in Town

By dustin

Posted: December 3, 2024

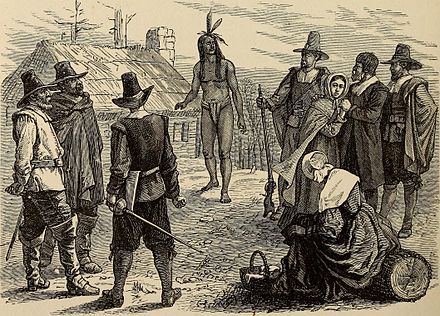

The Pilgrims Guide to Voluntary Slavery

By dustin

Posted: November 27, 2024

Who Pays for Trade

By dustin

Posted: November 8, 2024

Capital Won the Election

By dustin

Posted: November 7, 2024

A New Game Just Like the Old Game

By dustin

Posted: October 20, 2024

The Cost of the Dollar Status Quo

By dustin

Posted: October 15, 2024

Capital Components

By dustin

Posted: September 25, 2024

FREE Newsletters:

"*" indicates required fields