The Cost of the Dollar Status Quo

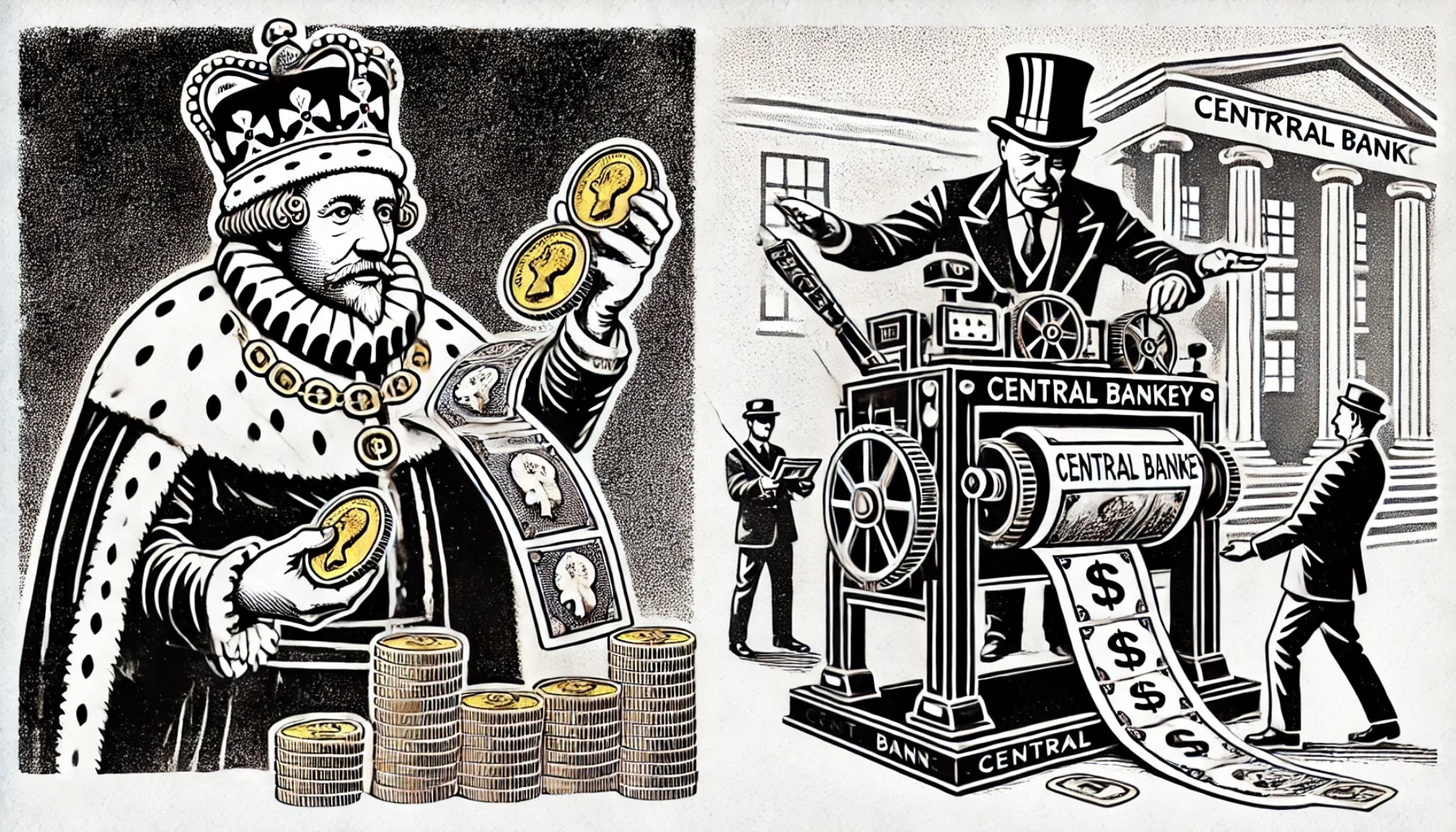

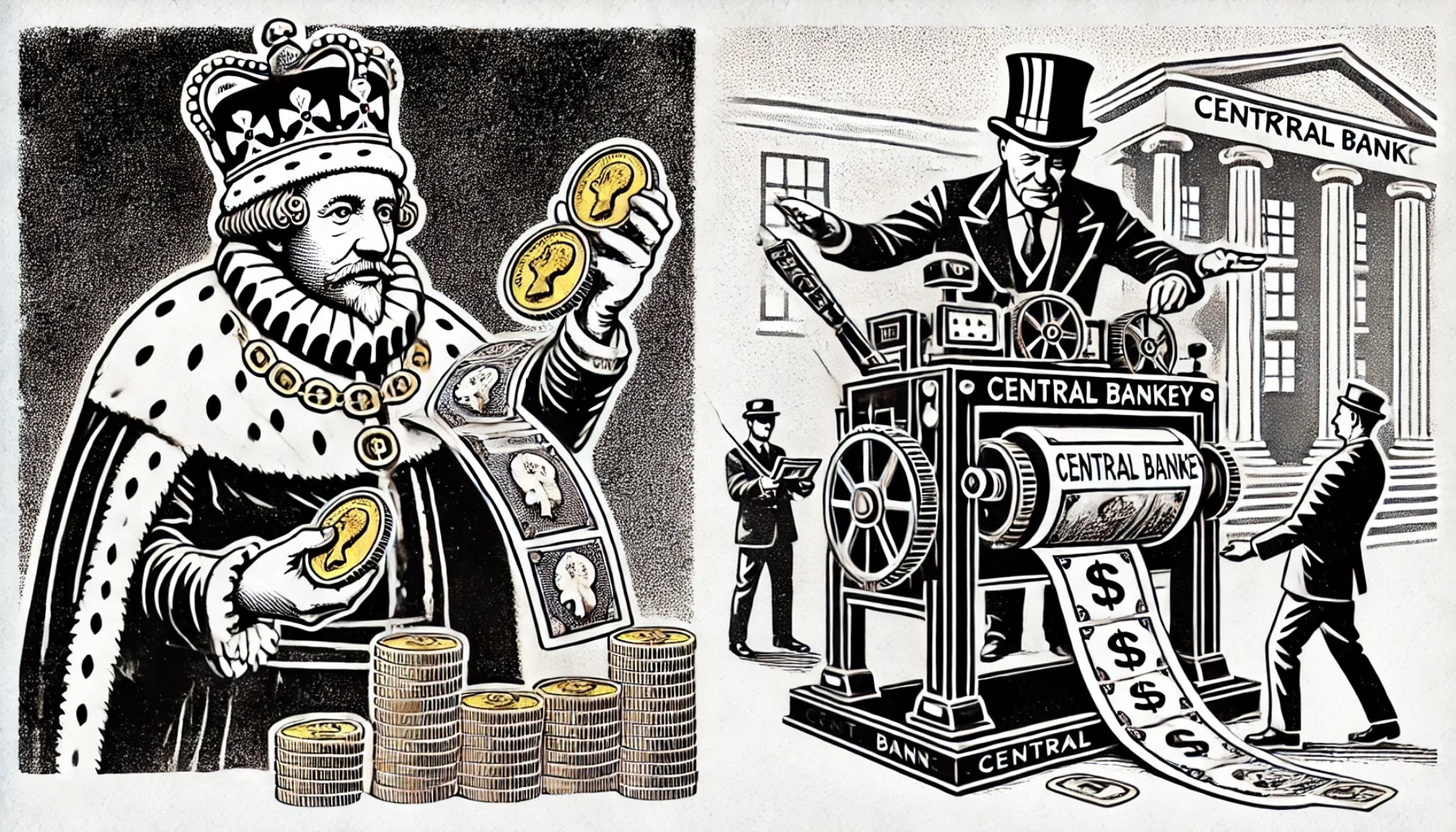

Yield power over money to any sovereign power, and history proves they will abuse it.

Expecting anything different makes as much sense as leaving a bowl of Skittles in the middle of a playground packed with 8-year-olds and hoping to return in an hour to enjoy some.

It doesn’t happen.

Whether through clipping gold and silver from coins of old or by printing money to sustain excessive spending today, fiat debasement has all the surprise of a full moon.

But I gotta admit, the U.S. has brilliantly managed their power of the purse over the last 70 years. Not to the advantage of savers, mind you. But, on balance, the United States’ exorbitant privilege has worked out well for most Americans.

At least so far.

The secret to that success boils down to one simple fact: well-established network effects for the U.S. dollar.

For decades, the dollar has dominated nearly all global economic activity.

Here’s how they pulled it off.

The Dollar Networks Burden

The Bretton Woods Agreement in 1944 made the dollar the world’s reserve currency. This postwar agreement pegged other currencies to the U.S. Dollar and made all dollars convertible to gold at a fixed rate of $35 per troy ounce.

Onwards, this system marched until 1971, when Nixon accelerated that shift by abandoning the dollar’s convertibility to gold. In 1974, the U.S. got Saudi Arabia to sell all its oil for dollars, and the Petrodollar was born. The SWIFT global payment system came online at that time, too, and Bob’s Your Uncle, the US Dollar, was used in almost all trade.

I’d also add another contributing factor to the U.S. dollar’s success – our mercantilist policies with China during the 90s and most of this century.

We fueled the rise of the Chinese economy by buying cheap Chinese goods with dollars borrowed at artificially low rates for the first two decades of this century.

The Chinese used those dollars to buy U.S. Treasury debt (helping keep rates low), effectively lending those dollars back to us so we could keep buying more Chinese goods on credit.

Together, these factors conveyed incredible networking effects to the U.S. dollar, allowing America to export the effect of debasement – inflation – to the rest of the world by building a dollar bid into all global trade.

Unfortunately, maintaining those network effects comes with a heavy price.

We play nice with despots. We overthrow regimes. And we waged war on countries that attempted to exit the dollar network.

All the while, the strong U.S. dollar network makes it easier and cheaper to wage those wars than it would be otherwise. From our perspective, it is a virtuous cycle as we barely notice the effects.

But that exorbitant privilege could be coming to an end.

That belligerence has split the global economy in two, with Russia, China, Iran, and many more countries (think BRICS) on one side and the West on the other—splitting the dollar network in half.

Whether Rubles, Yuan, Bitcoin, or gold, the dollar’s influence wanes, limiting how low the Federal Reserve can guide interest rates without igniting inflation.

So, you can add “less room to cut rates” to your list of reasons why this bull market may not last much longer.

Think Free. Be Free.

Don Yocham, CFA

Managing Editor of The Capital List

Related ARTICLES:

AI Eating Itself

By Don Yocham

Posted: December 20, 2024

How To Keep This Market Moving

By Don Yocham

Posted: December 11, 2024

Crushing the Competition

By Don Yocham

Posted: December 3, 2024

Nvidia: The Only Game in Town

By Don Yocham

Posted: December 3, 2024

The Pilgrims Guide to Voluntary Slavery

By Don Yocham

Posted: November 27, 2024

Who Pays for Trade

By Don Yocham

Posted: November 8, 2024

Capital Won the Election

By Don Yocham

Posted: November 7, 2024

A New Game Just Like the Old Game

By Don Yocham

Posted: October 20, 2024

The Cost of the Dollar Status Quo

By Don Yocham

Posted: October 15, 2024

Capital Components

By Don Yocham

Posted: September 25, 2024

FREE Newsletters:

"*" indicates required fields