AI Eating Itself

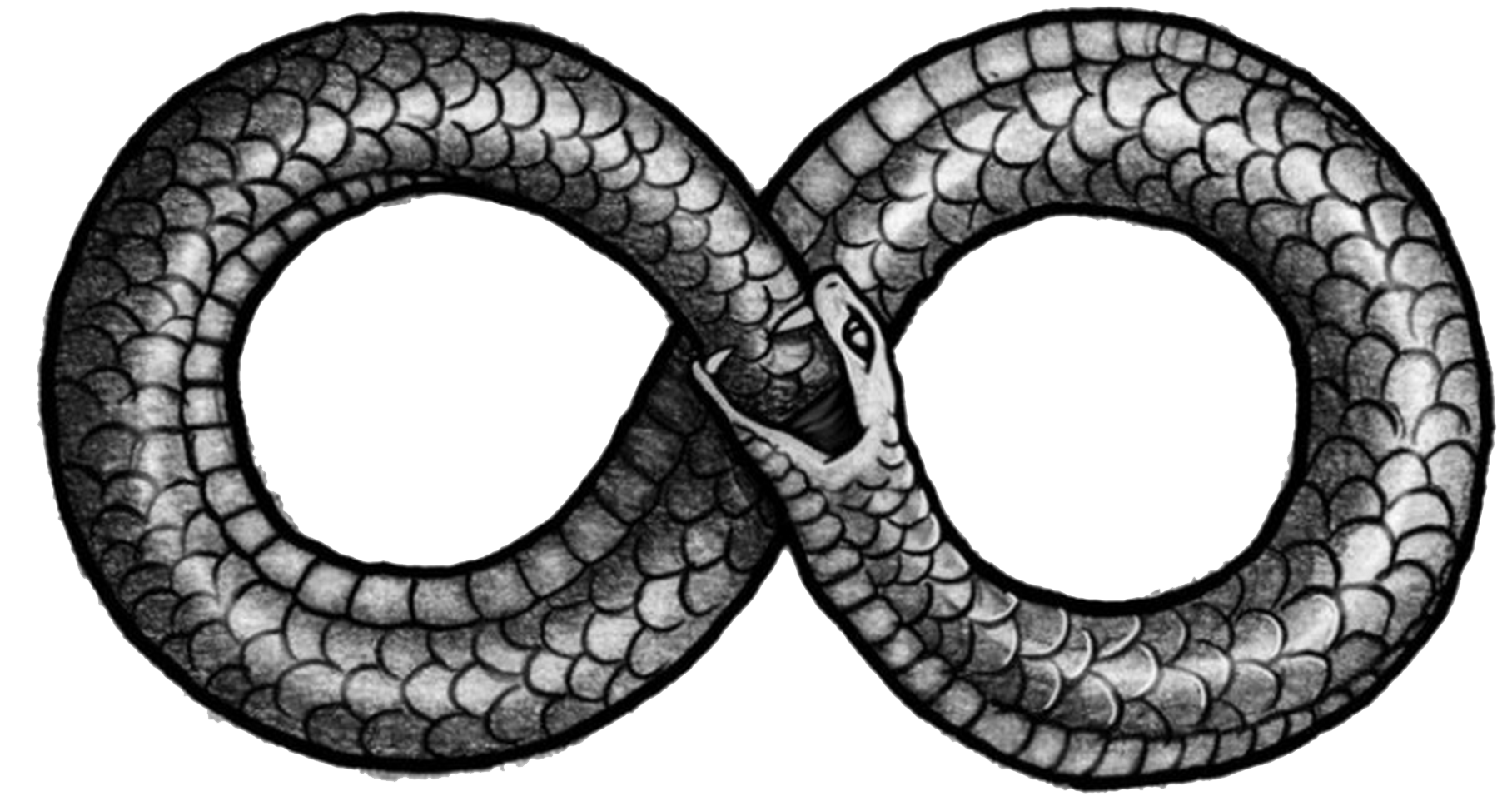

Nothing goes up in a straight line forever.

Every trend, process, or dynamic has limits. They encounter negative feedback loops that send them running in the other direction.

Nature herself provides them in abundance.

Get hot, you sweat, and you cool down.

When rabbits breed too much, you’ll soon have a lot of foxes.

Don’t tell climate alarmists this, but higher temperatures lead to higher humidity and more cloud cover, putting real limits on temperature trends.

That’s not to say that things can’t go to extremes. But they don’t keep going on forever.

You see it in markets and the economy, too, especially when over-investment and speculation follow new innovation.

Railroads in the late 1800s, autos in the 1920s, and, of course, the internet had its reckoning at the turn of this century.

But AIs most immediate limit may not be too much capital.

That limit, as I will show you, comes from within.

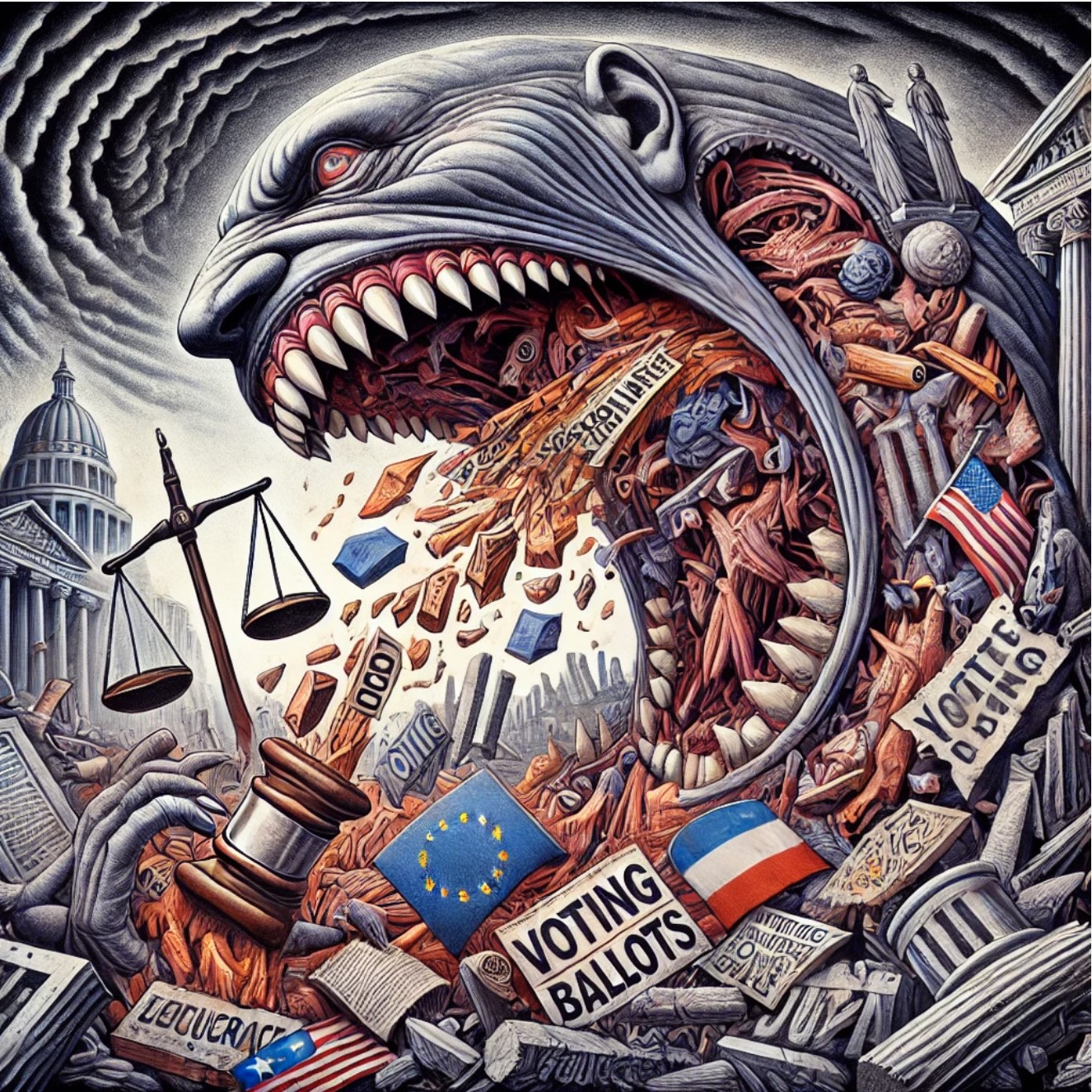

AIs Negative Feedback Loop

AI models are trained on data.

That data doesn’t come from a database. It comes from articles, books, videos, and other human-generated content.

By reading, “watching,” and otherwise consuming all types of content, AI models learn to predict what a human would say or reason.

We’re seeing the results of that training with a flood of AI-generated content.

And it is a flood.

Analysts predict that up to 90% of all internet content could come from AI by next year. By 2030, we’re looking at 99%.

With predictions like these, it’s hard to see what will be left for humans to do.

But that’s where limits enter the scene.

AI models scour the internet for input. However, when that input is AI-generated—or when AI eats itself—the AI model will collapse.

Train an AI on AI-generated data and it compounds errors, draws poor conclusions from that data, and essentially just repeats itself.

Basically, it builds predictions off data that was itself a prediction, it learns too much of the same thing, and fails.

There are other limits too. Resources, including cooling equipment, building materials, networking, and the power to run the models all act as constraints to the growth of AI.

Now, don’t get me wrong. AI will have a massive impact just like trains, cars, and the internet had massive, positive impacts on economic growth.

But it’s important to always keep in mind that most business models emerging around highly disruptive innovations fail. They either miss the point or invest too heavily to weather the inevitable correction.

Only a few make it through to emerge as winners on the other side.

Which means you need to work really hard to focus your capital on those companies best situated for the long run.

In the case of AI, Nvidia Corp. (NASDAQ: NVDA) looks like a clear long-term winner.

Expensive, but Worth It

The market wants Nvidia chips.

And it’s willing to wait.

That’s because Nvidia has spent well over a decade debugging software and driver issues for its CUDA software programming system. This gives it a critical edge as it will take years for its competitors to work through the same issues.

It also works with any cloud platform, giving customers crucial flexibility, especially relative to Amazon and Google custom chips, which only work on their respective cloud platforms.

Nvidia’s market share, platform stability, and developer toolkit make it the preferred vendor for developers. An entrenchment that actually creates a positive feedback loop for its future growth.

Finally, Nvidia’s chips outperform the competition.

Corporate investment spending on AI is just getting started. And it’s already massive.

Microsoft, Google, Meta, and Amazon will each invest around $40 to $50 billion in data centers over the next year to build out their capacity to deliver AI solutions.

As Eric Schmidt, former Google CEO, recently stated, “If $300 billion is all going to go to Nvidia, you know what to do in the stock market.”

As I show in this Capital InFocus report on Nvidia, the stock is rich but worth it.

There are no comparable alternatives to Nvidia chips. The stock won’t go up in a straight line forever, but from where we stand now, it has the best chance of weathering the inevitable AI correction to emerge a winner on the other side.

Think Free. Be Free.

Don Yocham, CFA

Managing Editor of The Capital List

Related ARTICLES:

American Exceptionalism, v2.0

By Don Yocham

Posted: February 12, 2025

The Holy Trinity of Growth

By Don Yocham

Posted: February 7, 2025

The War for the American Way

By Don Yocham

Posted: February 7, 2025

Draining the Moat

By Don Yocham

Posted: February 2, 2025

Deep-Sixed AI Dreams

By Don Yocham

Posted: January 28, 2025

From FUD to Oil and Gas Clarity

By Don Yocham

Posted: January 25, 2025

Waking Up to the “Drill Baby, Drill” Dream

By Don Yocham

Posted: January 22, 2025

This Ain’t Your Mother’s Internet Bubble

By Don Yocham

Posted: January 21, 2025

Tariff Winners and Losers

By Don Yocham

Posted: January 17, 2025

The Odds Favor Growth

By Don Yocham

Posted: January 14, 2025

FREE Newsletters:

"*" indicates required fields